Scott Galloway has blunt 6-word response to Social Security fight

The New York University professor has a strong opinion on one Social Security controversy.

Many working American citizens making ready for retirement (no topic their age) get questions about saving and investing for the lengthy speed, Social Security, and the federal program's future viability.

Creator and podcaster Todd Galloway starkly addresses one Social Security policy detail with a transient assertion explaining his controversial realizing.

Don’t omit the pass: SIGN UP for TheStreet’s FREE Day by day e-newsletter

One quiz of us in general get about Social Security involves whether or not its benefits are enough to solely rely upon right through retirement.

The consensus amongst retirement experts is that the acknowledge isn't any; other savings and investment autos should be deliberate for right through one's working years.

Linked: Scott Galloway warns American citizens on Social Security, retirement money

The most standard retirement savings instruments American citizens employ to free them from future dependence on Social Security month-to-month paychecks are employer-sponsored 401(k)s and tax-advantaged IRAs (Individual Retirement Accounts).

Many wonder which of these is better for retirement savings. The acknowledge is that each, primitive together, is a tidy components.

Because a 401(k) usually involves an employer match up to a selected percentage of an worker's earnings, one good advice is to rob the match up to its most, and make investments the relaxation in an IRA.

Roth IRAs are in general instantaneous, because taxes are paid up entrance, which enables for withdrawals in retirement to be made tax-free.

One more notify of us get about Social Security is whether or not or not this would perchance also be spherical after they retire. With out legislative action, it is miles reported that its Primitive-Age and Survivors Insurance (OASI) Have faith Fund will speed out of money in 2033.

At that time, continuing Social Security earnings would easiest be enough to pay recipients Seventy 9 percent of their expected benefits.

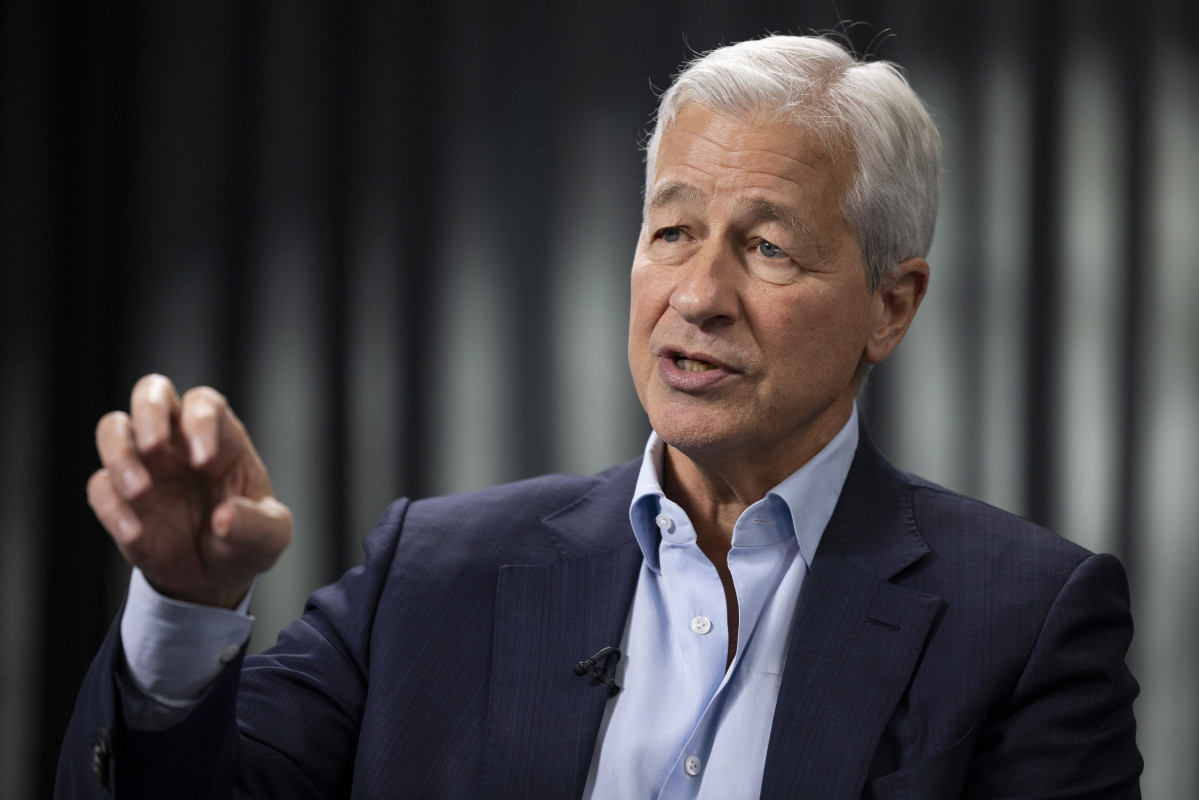

Galloway, nonetheless, has a proper realizing about every other policy notify regarding how Social Security is funded. Shutterstock

Scott Galloway explains the Social Security tax in 6 words

Galloway explained a blunt realizing of his on a diversified fight he would pick about how American citizens should pay for Social Security.

"I point out, the Social Security tax," Galloway said in a press unlock he posted to Instagram. "For instance you may very properly be making $150,000 a three hundred and sixty five days. You pay $9,000 a three hundred and sixty five days or approximately 6% in Social Security taxes. If I invent $1.5 million a three hundred and sixty five days, I pay — await it — $9,000 a three hundred and sixty five days. Social Security tax tops out at 160K."

Galloway then boiled his realizing about the Social Security tax all of the draw down to a extraordinarily transient assertion.

"That makes it a regressive tax," he said.

Fundamentally talking, a regressive tax is one who is more of a burden on decrease-earnings of us, since the quantity of the tax applies uniformly, no topic one's earnings stage.

Extra on deepest finance:

- Tony Robbins has blunt words on IRAs, 401(k)s and a tax fact

- Scott Galloway warns U.S. personnel on Social Security, retirement flaw

- Dave Ramsey explains a Roth IRA, 401(k) blunt truth

"So this factual reflects what has came about at some level of every swap and that is earnings inequality inner the swap," Galloway continued. "CEO compensation is uncontrolled. I assemble not know if there is something you may conclude about it."

"What you may conclude is on the least get them pay their ideal portion of taxes."

Linked: Scott Galloway has 6-note response to mortgage, rent, home disaster

Scott Galloway believes Social Security should be components-tested

Previously, Galloway has expressed an realizing that he believes, as someone who makes $16 million per hear, he mustn't be eligible to ranking Social Security.

"They call it a Social Security tax," he said. "There are a form of taxes I pay the keep I assemble not register the benefits. It isn't called the Social Security Pension Fund."

Galloway explained that, over time, most oldsters that ranking Social Security conclude up taking out two or three conditions the quantity of money they pay into it by the employ of the Social Security tax.

This, Galloway said, is an argument for components-making an are attempting out.

The pondering is that Social Security month-to-month benefits point out a lot more to an person for whom it is the next percentage of their general retirement earnings than to an person for whom it is miles easiest a small percentage.

That being the case, Galloway believes that for folks at a selected earnings stage, Social Security paychecks are simply not major.

Linked: Mature fund manager unveils factor in-popping S&P 500 forecast

What's Your Reaction?