Stock Market Today: Stocks higher with jobs data in focus, Nvidia jumps

The S&P 500 is off to a solid January start, but investors are concerned over a lack of market breadth.

Check support for updates all around the trading day

U.S. equity futures edged elevated in early Tuesday trading, whereas Treasury yields steadied and the buck slipped, as investors seemed to the first of a series of job market records releases that will maybe test the market's early January rally.

Stocks ended firmly elevated on Monday, with megacap tech names, and a recent declare excessive for Nvidia (NVDA) once more pacing gains and lifting the S&P 500 to a 0.55% advance by the shut of trading.

The Nasdaq, within the period in-between, jumped 1.24% as the tech sector continues to dominate investor sentiment whereas stoking worries of an overreliance on the so-referred to as Graceful 7.

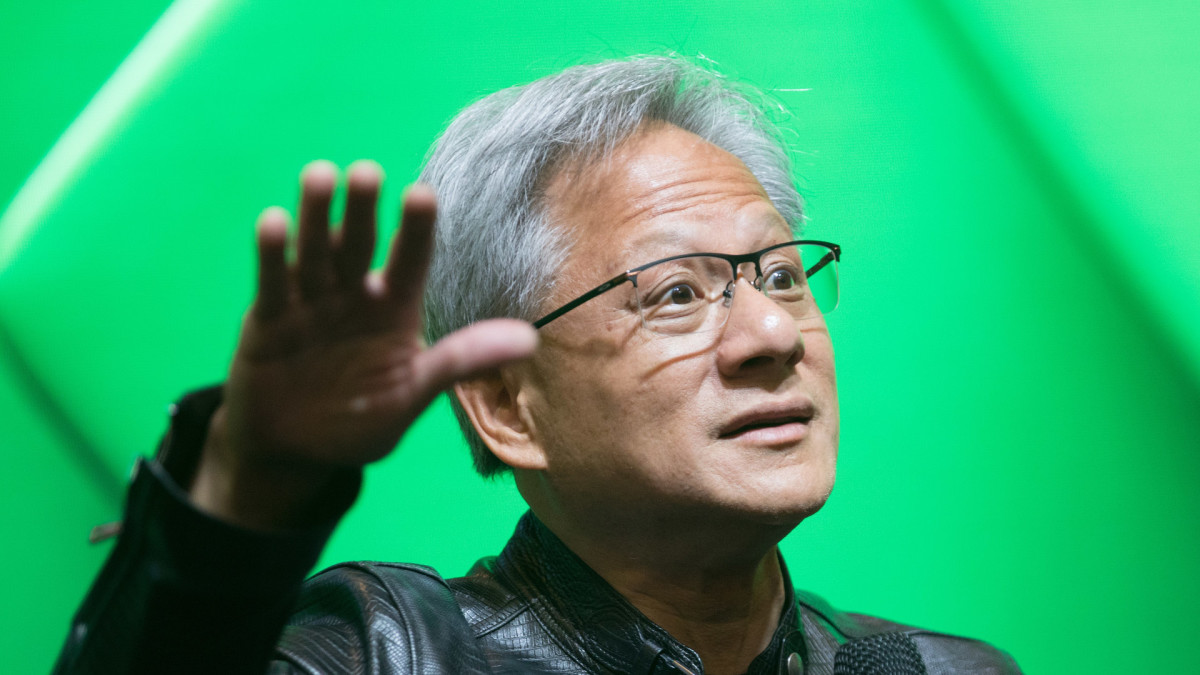

Nvidia shares, as successfully as the broader semiconductor space, are inclined to be support in focal point on the present time following a keynote take care of by CEO Jensen Huang to the User Electronics Show in Las Vegas closing evening. Shutterstock

Huang printed new gaming chips, an AI-powered notebook computer and plans to infuse the new abilities all over a wide differ of industrial segments. Shares within the tech broad were closing marked 1.6% elevated in premarket trading.

The Labor Department will free up it November job openings declare later this morning, the first of 4 records releases over the week that concludes with Friday's December non-farm payrolls substitute.

Economists are awaiting to peek a modest uptick in unfilled positions over the month, with a headline tally of seven.73 million, but are inclined to focal point on the so-referred to as quits price to resolve labor market momentum into the final weeks of closing twelve months.

Connected: Bonds defend the keys to what's subsequent for shares

Bond markets can even be in focal point with the sale of $39 billion in re-opened 10-twelve months notes later this morning, following on from a blended public sale of 3-twelve months paper closing evening that drew stable domestic demand but seen a lunge in international bidder interest.

Benchmark 10-twelve months mark yields were minute changed at 4.642% heading into the launch of the New York trading session, with 2-twelve months notes easing support to 4.274%.

The U.S. buck index, which tracks the buck towards a basket of six worldwide currencies, became marked 0.26% lower at 107.972 as the euro popped modestly elevated following a faster-than-expected discovering out for December inflation all around the eurozone establish.

Connected: Stocks face correction likelihood as Santa Claus Rally fails to bring

Heading into the launch of the trading day on Wall Aspect road, futures contracts tied the S&P 500 are indicting a modest 6 point opening bell impact whereas those linked to the Dow Jones Industrial Reasonable are priced for a Forty five point bump.

The tech-centered Nasdaq is referred to as 17 ingredients elevated with Nvidia, Micron Know-how (MU) , Fling Energy (PLUG) and Tesla (TSLA) active in premarket trading.

Extra Wall Aspect road Evaluation:

- Ragged trader picks battered stock as top stock to acquire

- Ragged trader who accurately picked Palantir as top stock in ‘24 reveals best stock for ‘25

- Ragged fund manager reveals surprising Nvidia stock brand aim for 2025

In in a single other country markets, the regional Stoxx 600 benchmark nudged 0.15% elevated in Frankfurt whereas Britain's FTSE 100 slipped 0.21% in mid-day London trading.

In a single day in Asia, Japan's Nikkei 225 adopted closing evening's rally on Wall Aspect road with a stable 1.97% impact, helped in part by a weaker yen and rising chip shares, whereas the regional MSCI ex-Japan benchmark rose 0.19% into the shut of trading.

Connected: Ragged fund manager elements dire S&P 500 warning for 2025

What's Your Reaction?