Stock Market Today, Jan. 30: President Trump makes market-moving announcement about the future of Federal Reserve

This live blog is refreshed periodically throughout the day with the latest updates from the market.To find the latest Stock Market Today threads, click here. Happy Friday. This is TheStreet’s Stock Market Today for Jan. 30, 2026. You can follow the latest updates on the market ...

This live blog is refreshed periodically throughout the day with the latest updates from the market.To find the latest Stock Market Today threads, click here.

Happy Friday. This is TheStreet’s Stock Market Today for Jan. 30, 2026. You can follow the latest updates on the market here in our daily live blog.

Update: 10:00 a.m.

Opening Bell

The U.S. market is now opened for the day.

This morning, President Doland Trump announced his new Fed Chair pick: Kevin Warsh, who served as a Fed Governor from 2006 to 2011. In the more than decade since Warsh left his post at the central bank, he has served on the board of United Postal Service, become a lecturer at Stanford, and taken up a few other posts.

Warsh had been an advocate for higher interest rates, shrinking the Fed's $7 trillion balance sheet, and letting asset prices fall. In other words, swap lower rates for lower asset prices. But how? Warsh reckons that the structural, years-long boom in productivity should lead to rate cuts.

He's also critical of the central bank. Many would call him "hawkish", which will be interesting to square with the President's desire to win a more sympathetic, dovish Fed. To that end, Warsh is likely to be squarely focused on the central bank's own matters than factors beyond its dual mandate.

Outside of that purview, the 55-year-old is unlikely to err much into politics or theatrics. However, we'll have to wait to see how his confirmation to the Fed really changes things --- and to that end, he will first need the approval of both Democrats and Republicans, which might not happen until an investigation brought by the President against the incumbent Fed Chair has wrapped.

In reaction to this morning's big announcement, U.S. benchmarks briefly dipped to session lows; the Nasdaq (-0.41%), Russell 2000 (-0.37%), Dow (-0.35%), and S&P 500(-0.31%) are all lower. The Russell's malaise appears to be continuing into the 10 a.m. hour, while the other three indexes appear to be bouncing.

The 10YTreasury is 2 basis points higher at 4.247%, another sign of reaction from the fixed income crowd. The 20Y and 30Y are 2.3 bips and 2.6 bips higher at 4.832% and 4.88%.

Also notable, after technical difficulties delayed the start of trading at the London Metal Exchange, continuous futures in high-flying metals are lower today. Gold (-5.29% to $5,071.60) and Silver (-13.51% to $98.97) are seeing some pretty steep declines. On the flip side, energy commodities like Natural gas (+5.05% to $4.166%) and Brent crude oil(+0.23% to $69.75) are seeing a nice bump.

Heatmap: S&P 500

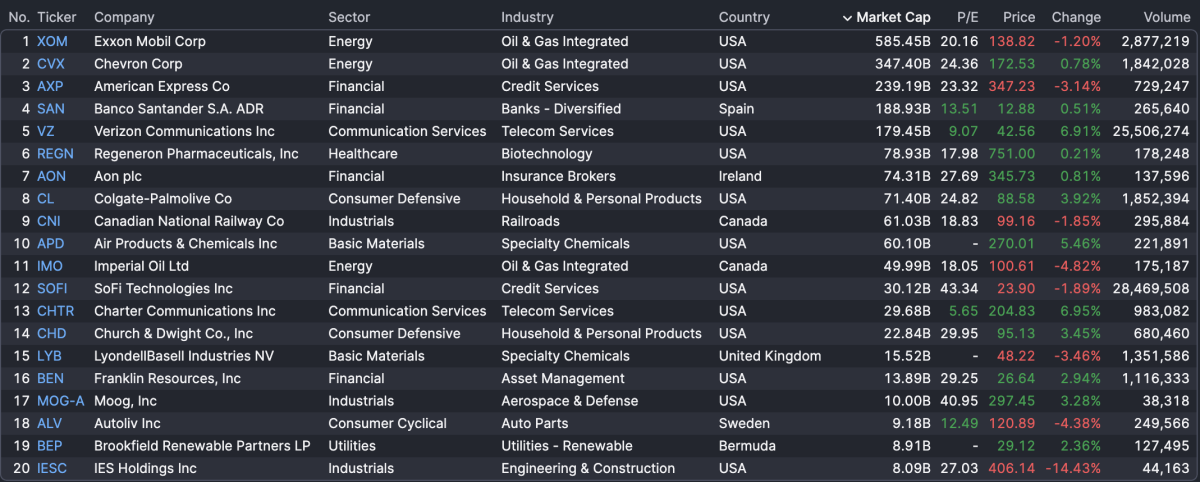

That said, here's a glimpse of the S&P 500, the best-situated index this morning among major U.S. benchmarks. Telecom giants are the brightest green pocket this morning after Verizon's earnings (more below), while credit services are lower after American Express reported.

Earnings Today: Exxon Mobil, Chevron, American Express

This morning saw a wide array of earnings, including oil firms Exxon Mobil and Chevron, payment processor American Express, and others. Among the bigger moves in the largest reports of the day are Verizon (+6.91%) and IES Holdings (-14.43%). Here's the list of A.M. reports for today:

After the market close, FinViz says that there will be two reports at size, both foreign: Japan's Sumitomo and Nomura will report, both financials.

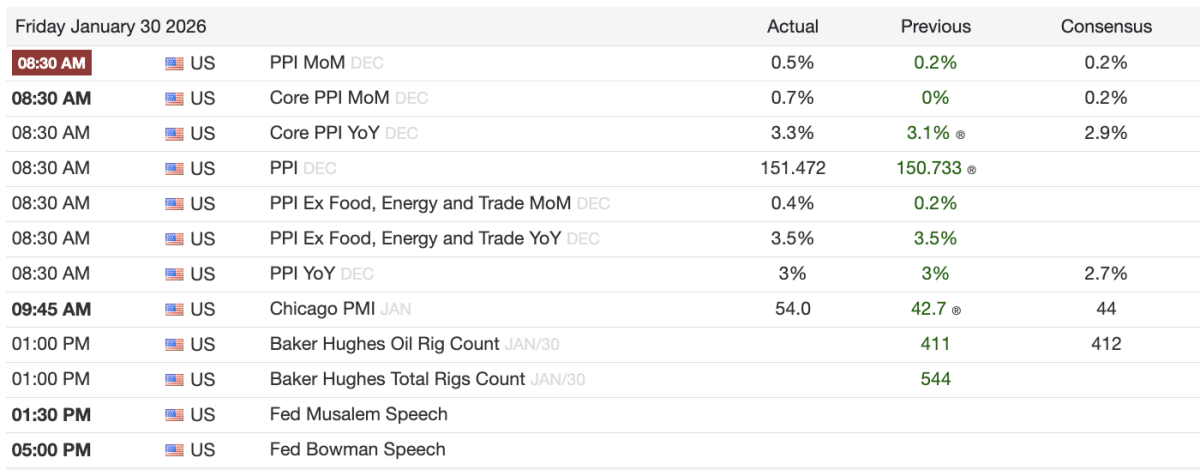

Economic Events: Fed Chair Pick, Producer PRice Index, Chicago PMI

Aside from President Doland Trump announcing his new pick for Fed Chair, there were also a number of economic reports released this morning, including the Producer Price Index. Here's the shortlist:

What's Your Reaction?