Stock Market Today: U.S. Stocks Mixed After Oracle Earnings, Fed's Quarter-Point Cut

This live blog is refreshed periodically throughout the day with the latest updates from the market.To find the latest Stock Market Today threads, click here. Happy Thursday. This is TheStreet’s Stock Market Today for Dec. 11, 2025. You can follow the latest updates on the ...

This live blog is refreshed periodically throughout the day with the latest updates from the market.To find the latest Stock Market Today threads, click here.

Happy Thursday. This is TheStreet’s Stock Market Today for Dec. 11, 2025. You can follow the latest updates on the market here in our daily live blog.

Update: 9:35 a.m. ET

A.M. Update

The U.S. markets are now open. The Dow (+0.40%) is leading the pack this morning, trailed by a Russell 2000 (+0.20%) fresh off intraday highs and a record close.

At the same time, the more diversified large cap indexes like the S&P 500(-0.36%) and Nasdaq (-0.71%) are in decline this morning. Leading the charge lower is Oracle (-14.8%), which ignited fresh fears about the staying power of the AI boom in its after hour earnings report yesterday.

Oracle Credit Default Swaps (CDS) surged 139 basis points, while its $100 billion rout weighed on the rest of the tech sector this morning.

Zooming out, U.S. jobless claims rose by 44,000 in the latest week, hitting 213,000. However, the continuing benefits fell by 99,000, coming in at 1.84 million, the lowest level since Apr. 2025.

In continuous futures, Silver (+3.39%) is on a run again today after smashing through the $60 point. This morning, it's up another $2 to $63.11. Gold (+0.93% to $4,263) is also joining it to the upside. Meanwhile, energy commodities like Natural Gas (-5.18% to $4.357) and Brent Crude (-1.96% to $60.99) are in decline.

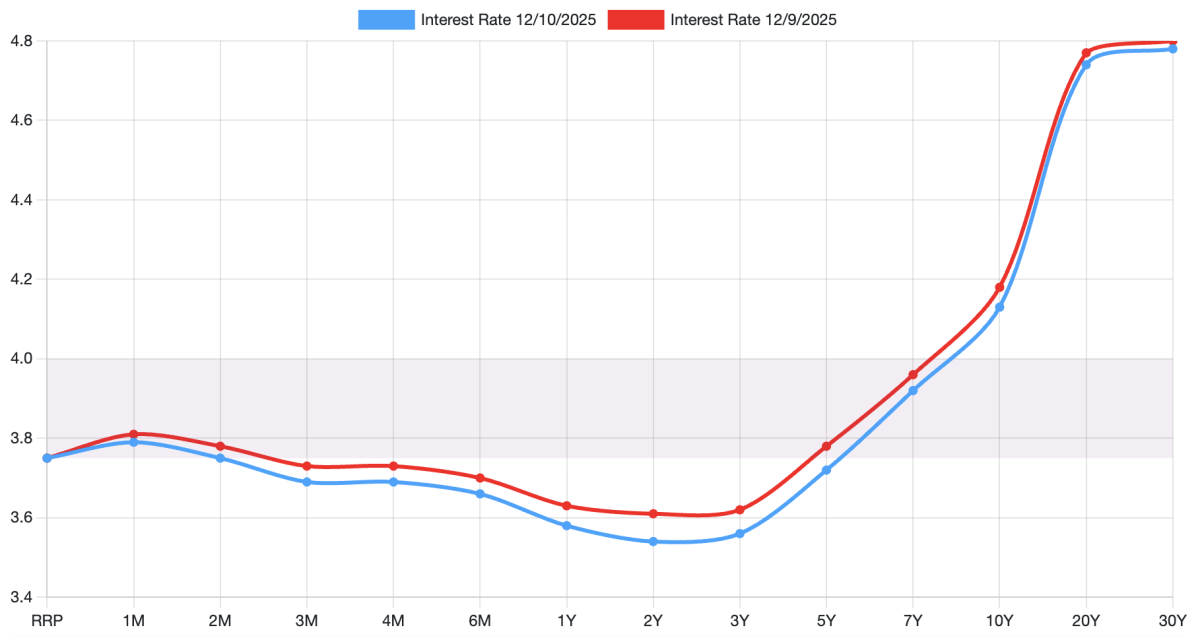

Also notable, U.S. Treasury yields have dropped a bit across the yield curve, reflecting optimism about the Fed's commentary yesterday. Here's a look at today (blue) vs. yesterday (red):

Finally, after the Fed's quarter-point cut, the U.S. Dollar Index hit a seven-week low at 98.46.

Update: 8:38 a.m. ET

A.M. Update

Good morning. Much attention has been paid to the guesswork in the Fed's December policy meeting, but now that it's in the rear view and we have a quarter-point cut in hand, the estimation is that the central bank was more dovish than originally thought -- and even bullish in some ways.

That revelation is paying off this morning as U.S. equities futures are split. The Russell 2000 and Dow are up, while the S&P 500 and Nasdaq are in 'sell the news' mode. Yields also fell.

Here's what is on deck for today's trading day:

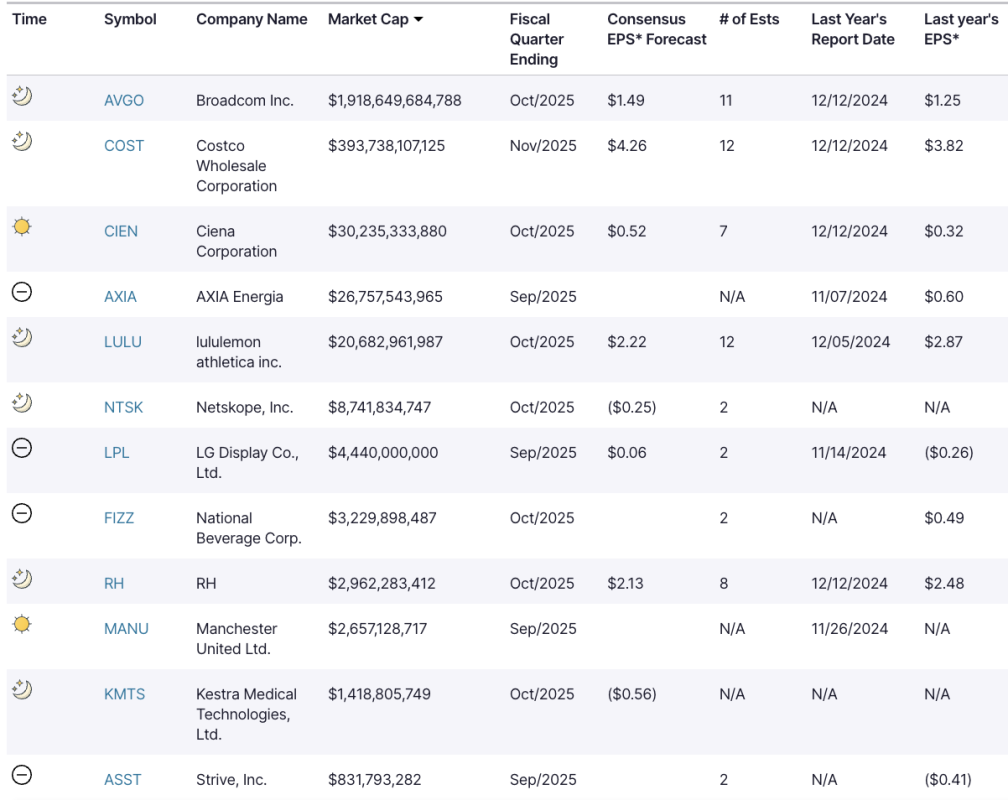

Earnings Today: Broadcom, Costco, Lululemon

This morning's largest reports come from Ciena Corporation and Manchester United, but if you want a stock that will define the day -- and perhaps the week -- you might want to hold out until Broadcom reports after the market close. It'll be joined by Costco and lululemon, among others. Here are today's earnings with a market cap of at least $1 billion:

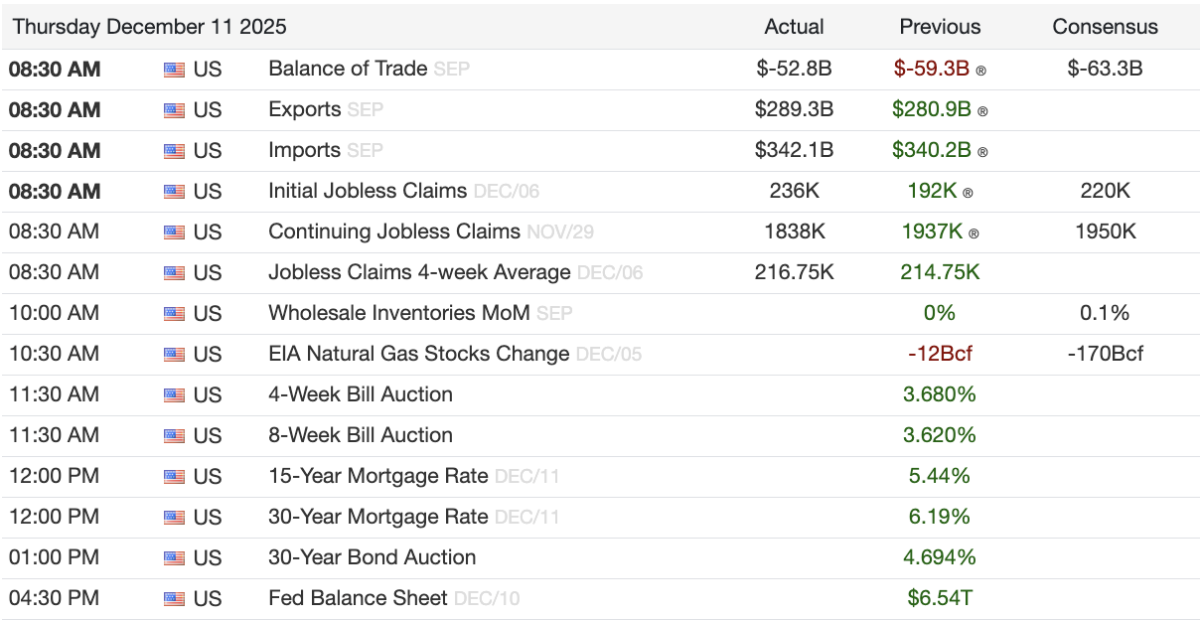

Economic Data + Events: Exports, Imports, Jobless Claims

This morning, we have exports and imports data, plus the latest jobless claims in the U.S. economy. Here's an updated graphic (9:41 a.m.) of today's events, plus what remains:

What's Your Reaction?