Stock Market Today: U.S. Stocks Rise After PayPal, UPS Earnings; Apple Supplier Merger News

This live blog is refreshed periodically throughout the day with the latest updates from the market.To find the latest Stock Market Today threads, click here. Happy Tuesday. This is TheStreet’s Stock Market Today for Oct. 28, 2025. You can follow the latest updates on the market here ...

This live blog is refreshed periodically throughout the day with the latest updates from the market.To find the latest Stock Market Today threads, click here.

Happy Tuesday. This is TheStreet’s Stock Market Today for Oct. 28, 2025. You can follow the latest updates on the market here in our daily live blog.

Update: 8:17 a.m. ET

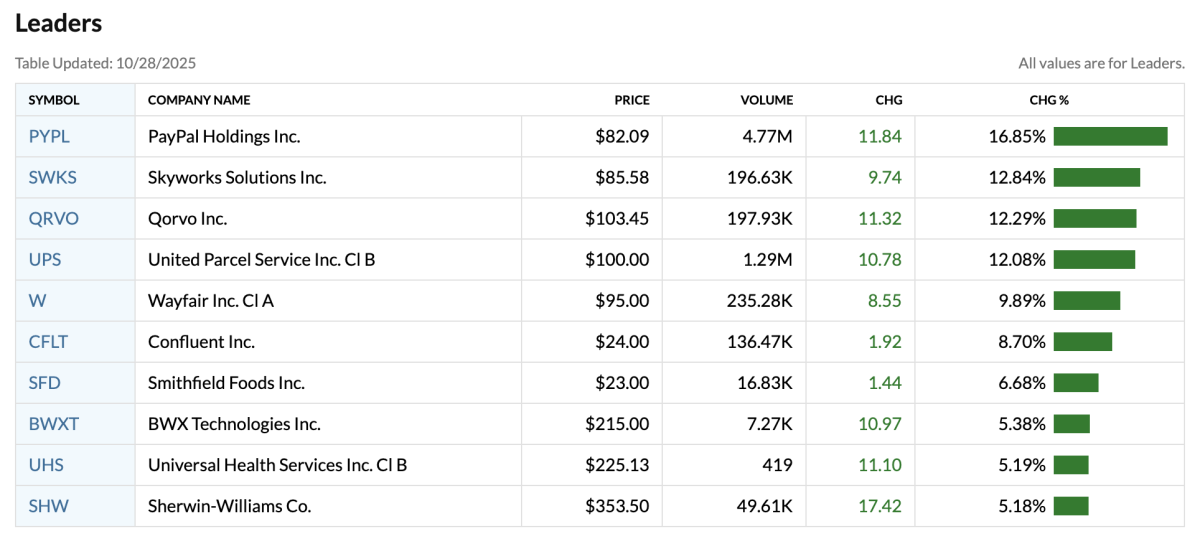

Pre-Market Movers: PayPal, F5, UPS, Royal Caribbean

A handful of yesterday's after hours reports and some of this morning's pre-market reports are making headway before the market open. Per MarketWatch, here are the stocks making the biggest moves before the market open:

Movers

Leading the premarket movers this morning is PayPal (+16.9%), which is jumping after announcing a deal with AI giant OpenAI. It's followed by Apple supplier Skyworks (+12.9%), who's fixing to buy Qorvo (+12.3%) in a $22 billion semiconductor merger. United Parcel Service (+12%) rounds out the top stocks after its earnings this morning, which handily beat analysts' revenue expectations and showed signs that an ongoing turnaround was still going strong.

Losers

On the flip side of the market, cybersecurity company F5 Inc, (-10%) is plummeting today after its P.M. earnings revealed that the impact of a cybersecurity incident would weigh on short-term demand. Alexandria Real Estate Equities (-8.8%) is also falling after missing earnings, while Royal Caribbean Group (-8.6%) declined after missed its revenue estimates and raising guidance.

Update: 7:47 a.m. ET

Everything Happening (That We Know Of)

Good morning. U.S. stock futures are are slightly higher this morning as the Federal Reserve kicks off its two-day Federal Open Market Committee (FOMC) meeting, where investors are hoping for an interest rate cut and guidance on the future trajectory of the central bank. At the same time, earnings season is hitting its stride this week, with over 450 companies expected to report between now and Jerome Powell's remarks to the press tomorrow.

Add in Trump's Asia trade deal adventure (which has already spurred a deal with Japan and could result in some sort of ink to paper with China), the still ongoing government shutdown and a looming deadline for the end of SNAP benefits; that's a picture of a fascinating next 36 hours for traders and the broader economy.

Even more so, considering that the Nasdaq Composite, S&P 500, and Dow have just booked record closes; the small cap-focused Russell 2000 has, too.

Plus, with big tech earnings looming heavy, there's no shortage of action coming out of the sector:

- PayPal (+6% premarket) announced a deal with OpenAI for an instant checkout product in the AI model during earnings.

- Amazon (+1%) says it will lay off 14,000 workers (lower than the 30,000 originally reported by Reuters) today.

- Oracle (-0.2%) CEO says he is "not worried" about an AI bubble, stressing that demand "far outpaces supply."

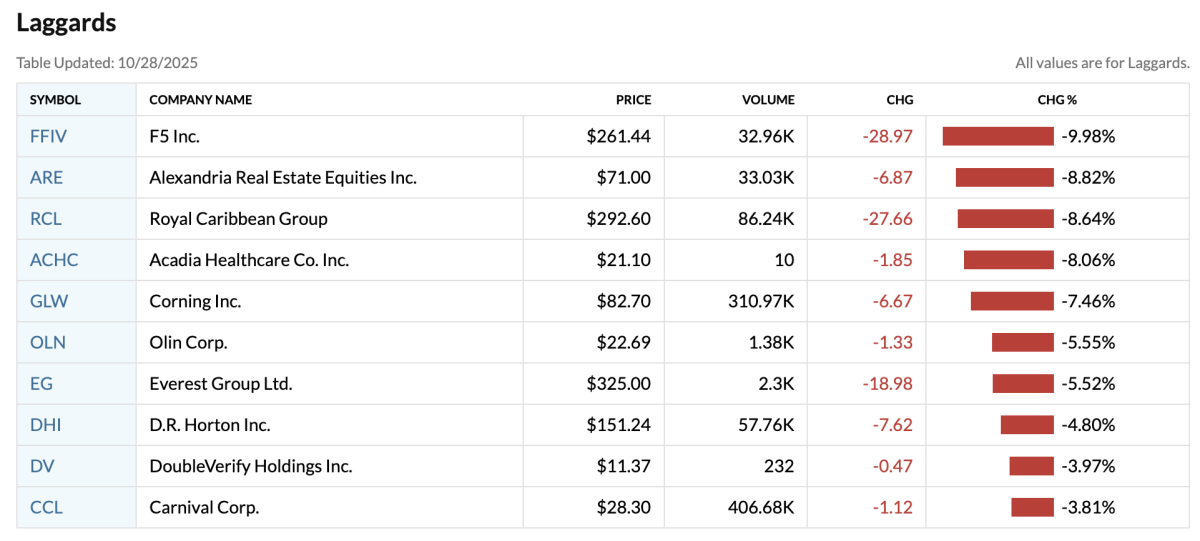

A.M. Earnings: UnitedHealth, Novartis, HSBC

This morning's largest earnings showings are already out, with UnitedHealth, Novartis, and HSBC Holdings posting their respective earnings. Here's a long list of the largest A.M. earnings, many of which have already been released:

This evening, we'll have even more big reports as Visa, Booking Holdings, and Mondelez International report in the P.M timeslot. In total, TipRanks says there's 86 reports today. If nothing else, it's a good warmup for tomorrow, which will be one of the busiest earnings days of the year.

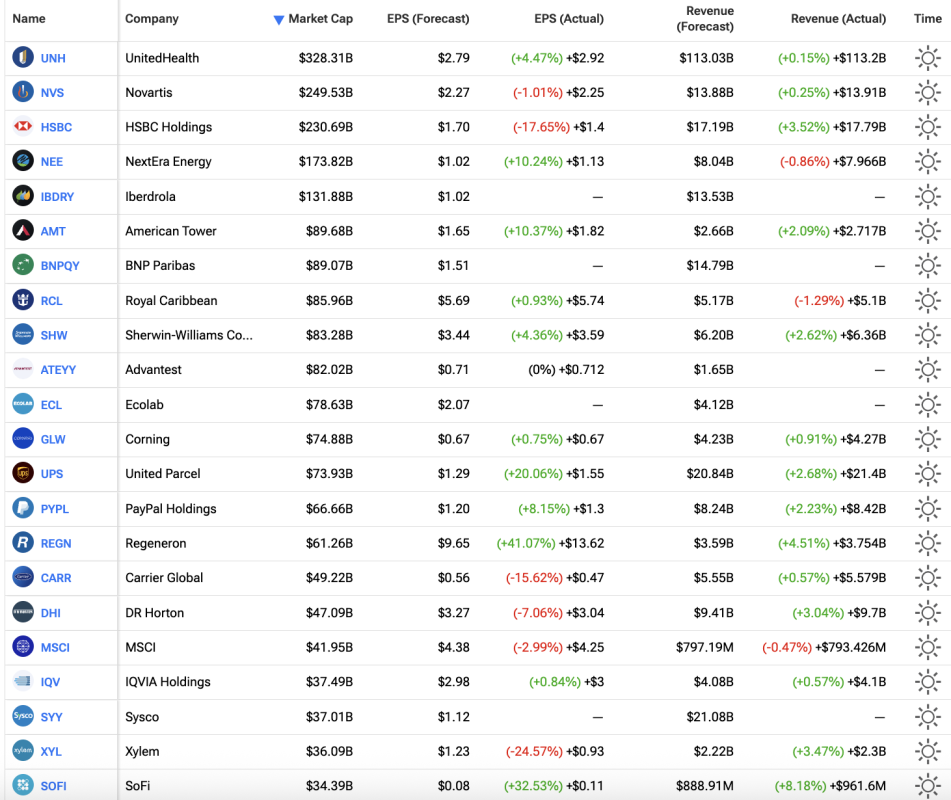

Economic Data + Events

Today marks the beginning of the Fed's two-day Federal Open Market Committee (FOMC) meeting, where the central bank is widely expected to cut interest rates by a 25 basis points. It'll also reveal the positions of the bank's various leaders, offering up a clue of whether or not there will be even more cuts by year-end.

Aside from the FOMC meeting, there's also a row of other economic data reports due out today. Per TradingEconomics, here's the list of notable prints to look out for:

What's Your Reaction?