Stocks face correction risk as Santa Claus Rally fails to deliver

Stocks ended 2024 with the best annual back-to-back gains since the late 1990s. That streak might not last.

U.S. shares face the menace of a famous pullback over the well-known few weeks of the twelve months, per some Wall Twin carriageway analysts, as markets retreat from the strongest bustle of reduction-to-reduction features since the late Nineteen Nineties.

Stocks did no longer roar a so-called Santa Claus Rally, a trend first identified by Yale Hirsch and the "Inventory Trader's Almanac" in 1972 as unheard of index features over the final five buying and selling days of any twelve months plus the well-known two of the next.

Per the definition, the S&P 500 is down spherical 0.fifty three% from its closing ranges on Dec. 23, the day sooner than the rally was to accumulate begun. And it had fallen for five classes, its longest losing high-tail since April, sooner than posting a solid Friday develop of 1.26%.

That compares with a normal develop of spherical 1.3%, per Hirsch's almanac, a tally that's spherical four and a half of times the authorized seven-day attain for the length of every other time of the twelve months.

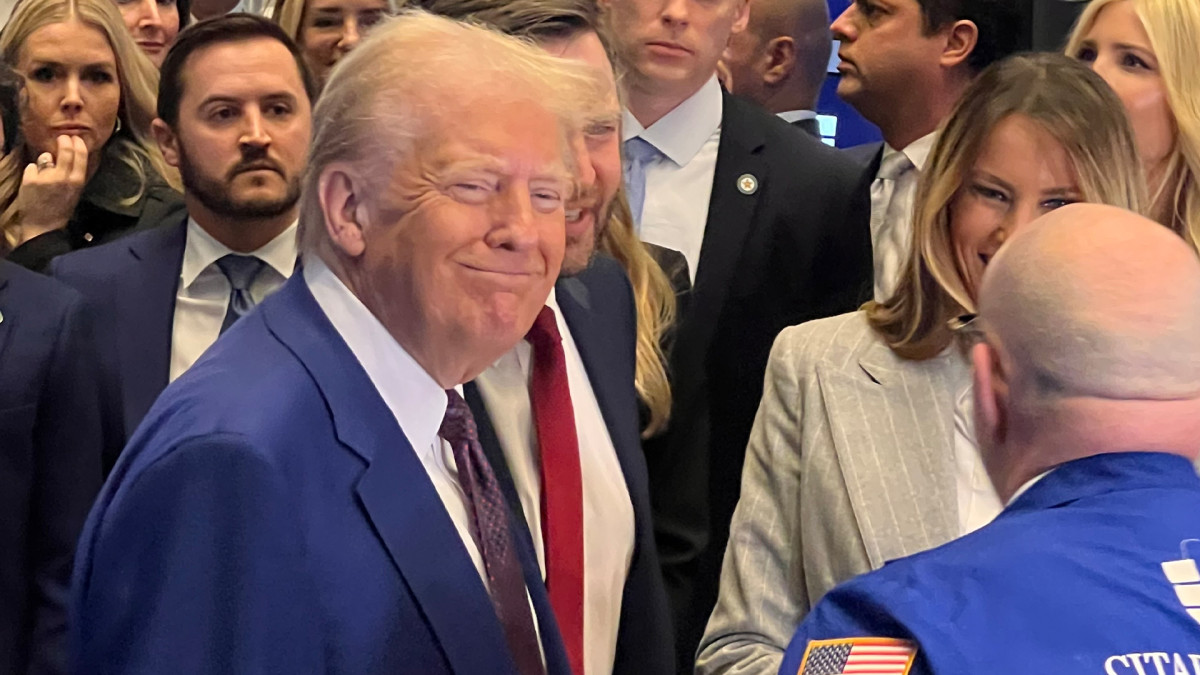

Tiny or no headline news has caused the pullback, and the broadest measure of U.S. shares is soundless within 3.5% of its all-time peak and up better than 2.4% since President-elect Donald Trump's victory in early November. Rebecca Mezistrano-TheStreet

"The Santa Claus Rally on the total generates diverse headlines attributable to the market’s tendency to publish solid returns over this rapid period — or presumably it receives more attention because it occurs for the length of a on the total slow financial news cycle," stated Adam Turnquist, chief technical strategist at LPL Financial.

Inventory market faces rising headwinds

Quietly, on the other hand, determined headwinds that investors and analysts accumulate warned about are initiating to receive.

The Labor Division's reading of weekly jobless claims confirmed fewer Americans filing for first-time unemployment advantages, suggesting kill-of-twelve months resilience in wages, while the ISM's benchmark stamp of December manufacturing process rose to the very best stage in nine months.

Treasury bond yields are also creeping better, with benchmark 10-twelve months notes rising to 4.5621% in early Monday buying and selling, while rate-gentle 2-twelve months notes traded at 4.328%.

Related: Gangbuster S&P 500 returns count on one well-known thing in 2025

Those moves replicate broader adjustments traders are making in their shut to-time period Federal Reserve passion rate forecasts, with CME Group's FedWatch predicting best two reductions over the well-known half of of 2025.

Richmond Fed President Thomas Barkin essentially instructed an match in Maryland Friday that he saw "more upside than plot back in phrases of [economic growth] along with "more menace on the inflation aspect."

U.S. greenback index shut to 2-twelve months excessive

The U.S. greenback index, which tracks the greenback in opposition to a basket of six global currencies, is now buying and selling shut to the very best ranges in better than two years and has risen better than 7% exact thru the final three months.

That's at menace of lift a toll on S&P 500 earnings as companies obtain it more costly to bring in a international country profits reduction onto their U.S.-based books.

Turnquist notes that no decrease than per past performance, the S&P 500 most frequently falls spherical 0.2% in a January that follows a failed Santa Claus Rally, and delivers an irascible fleshy-twelve months return to investors when put next with a successful one.

"As Yale Hirsch build it, 'If Santa Claus should fail to name, bears may attain to Astronomical and Wall,'" Turnquist stated.

Related: US shares rule as bull market bets spotlight 'American exceptionalism'

"The S&P 500 has dipped below its 50-day appealing moderate but remains above its longer-time period uptrend," he added. "Nonetheless, we predict shut to-time period plot back menace remains elevated given the original deterioration in market breadth and momentum, stretched bullish sentiment, and macro headwinds from better rates and a stronger greenback."

Jay Woods, chief global strategist at Freedom Capital Markets, says the early 2025 stumble may mean markets are "in the early section of a 10% correction."

The original bull market, which began in late 2022, hasn't had a 10% pullback since October 2023, Woods stated. He sees action eerily an akin to that of the 2018 correction, when shares fell 20% from their late September peak and did no longer enhance those ticket ranges until the next February.

Inventory market reliance on the megacaps

"The general theme of 2024 was market rotation – which is the lifeblood of a solid and wholesome bull market," Woods stated. "Now we're rotating reduction into megacaps, but general breadth is regarding."

He also famed that the tariffs the Trump administration has proposed accumulate potential to maintain inflation elevated, and the spending cuts and immigration restrictions it's pondering about may injury job train.

David Morrison, senior market analyst at London-based Alternate Nation, on the other hand, is no longer delighted the market is offering a determined ticket exact yet.

More Wall Twin carriageway Diagnosis:

- Passe analyst who forecast Rocket Lab's inventory rally updates ticket purpose

- Analysts revamp Ciena inventory ticket purpose after AI outlook

- High analyst revisits Micron inventory ticket purpose sooner than Q1 earnings

"It’s beautiful to mediate that mighty of the original volatility and plot back strain comes because twelve months-kill window dressing and fund rebalancing, as managers shift their holdings between equities and bonds," he stated.

A failed Santa Claus Rally "may build a dent in transient sentiment, but let’s secret agent how issues run for the rest of this month, notably when we receive past Trump’s inauguration on Jan. 20," he added.

Related: Passe fund manager considerations dire S&P 500 warning for 2025

What's Your Reaction?