SVB Collapse: FDIC Removed $2 Billion Cash From Parent Company

The FDIC seized $2 billion from Silicon Valley Bank's former parent company, SVB Financial who may be on the hook for the bank's collapse.

The FDIC seized $2 billion from Silicon Valley Bank's former parent company, SVB Financial who may be on the hook for the bank's collapse.

The FDIC removed $2 billion in cash from SVB Financial Group, the former parent company of Silicon Valley Bank and its lawyers want the money back.

The federal regulator has blocked access to cash that was deposited to the bank from the holding company, SVB Financial, that served as the former parent company of the bank before it was shut down on March 10.

DON'T MISS: Is First Republic Bank the Next Domino to Fall?

The bankruptcy attorneys for SVB Financial said that the FDIC has not given them access to the cash.

SVB Financial's attorneys also said during the company's first hearing at bankruptcy court on March 21 that the FDIC is not communicating with the parent company.

The attorneys said the bridge bank for SVB was told by the FDIC to get back transfers of money made to other bank accounts

“Right now, not only has the bank been taken, but all of the cash has been taken,” James Bromley, a lawyer for SVB Financial Group, said at the New York hearing.

The FDIC closed the banking business, Silicon Valley Bank, and created a bridge bank called Silicon Valley Bridge Bank NA.

SVB’s failure is the second-largest of a bank in U.S. history and has shaken many investors. It was the result of a bank run, caused by the firm’s announcement that it failed to raise the additional capital to increase liquidity.

Silicon Valley Bank made investments into long-dated government securities, including Treasuries. The sale of them led to a $1.8 billion loss and the California bank attempted to raise $2.25 billion in capital by issuing new common and convertible preferred shares to cover the shortfall.

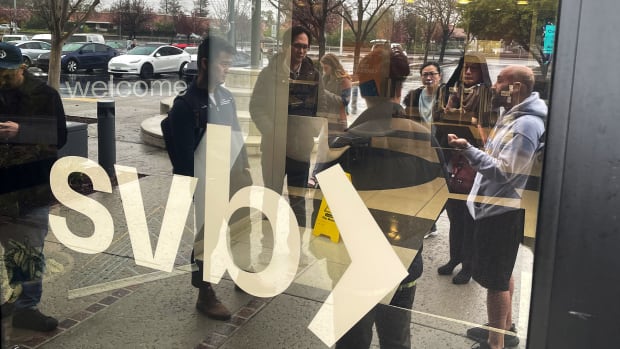

Depositors made a run on the bank, withdrawing their cash and transferring it into other banks. Getty

Depositors Can Withdraw Money

Regulators allowed depositors to withdraw money that was moved from the old bank to the new bridge bank.

But on March 16 the FDIC asked that SVB Financial’s $1.9 billion of deposits be moved to an account that is only controlled by the regulator.

The FDIC plans to maintain control of the money until it decides what claims could be made against the parent company, according to testimony at the hearing.

“The bridge bank cannot make withdrawals out of that account…without the FDIC receiver’s consent,” Sandeep Qusba, a lawyer for Silicon Valley Bridge Bank, said in court.

Bank holding companies can be liable for the losses that its banking subsidiaries incur. The liability to make up the losses is the result of the 2007 -09 financial crisis when several banks failed, including Washington Mutual, Bear Stearns and Lehman Brothers.

Unsecured Bondholders Owed $3.4 Billion

The unsecured bondholders are owed about $3.4 billion and could lose some of the funds if the FDIC is successful.

The attorneys for the FDIC did not disclose what kind of claims it could seek against SVB Financial or its value. But, the attorneys said freezing the $1.9 billion in deposit was conducted legally.

All of Silicon Valley Bank’s depositors have been able to withdraw their money if they chose to, but the ability to do so meant money was taken out of its Deposit Insurance Fund. The FDIC has not disclosed the amount that was withdrawn from the Deposit Insurance Fund.

The bankruptcy of the holdings company means its other businesses can proceed with sales of their own, including SVB Securities that operates as its investment banking division. SVB Capital serves as a $9.5 billion venture capital and private credit fund for third-party investors. SVB Private runs its wealth management unit.

What's Your Reaction?