Tony Robbins sends strong message on Roth IRAs, 401(k)s

The motivational speaker and finance author offers major retirement savings advice.

American workers planning for retirement basically earn a conventional blueprint of the roles 401(k) plans and IRAs (Particular person Retirement Accounts) play within the formulation.

Personal finance creator and philanthropist Tony Robbins provides some significant advice about every of those retirement savings instruments which would be wisely price desirous about.

Don’t omit the stride: SIGN UP for TheStreet’s FREE Day by day e-newsletter

Most continuously talking, employer-backed 401(k) plans offer workers matching contributions that reduction them to enroll in, to permit them to take good thing about that free money.

Up to a ultimate percentage of one's profits, those employer suits are successfully a guaranteed 100% return on a worker's funding.

Connected: Tony Robbins warns U.S. workers on Social Safety, retirement fact

The formulation of participating in 401(k) plans is always made straightforward by corporations that supply automatic enrollment — and the easy undeniable fact that contributions are taken straight from traditional paychecks.

Many employers offer the likelihood of contributing to Roth 401(k)s, in which taxes are paid up entrance and earnings grow tax-free.

Workers make selections from a chain of pre-chosen mutual funds and a form of funds which would be restricted to those within the market in a particular knowing.

American citizens are also strongly educated to make investments in IRAs. Within the case of Frequent IRAs, taxes are deferred until they should be paid when withdrawals are made in retirement.

For Roth IRAs, taxes are paid earlier than contributing, which permits for tax-free withdrawals after one has retired.

More flexibility is equipped to folks when contributing to IRAs, as there are extra funding selections within the market than with 401(k)s. They enable for shares, bonds, ETFs and a form of choices.

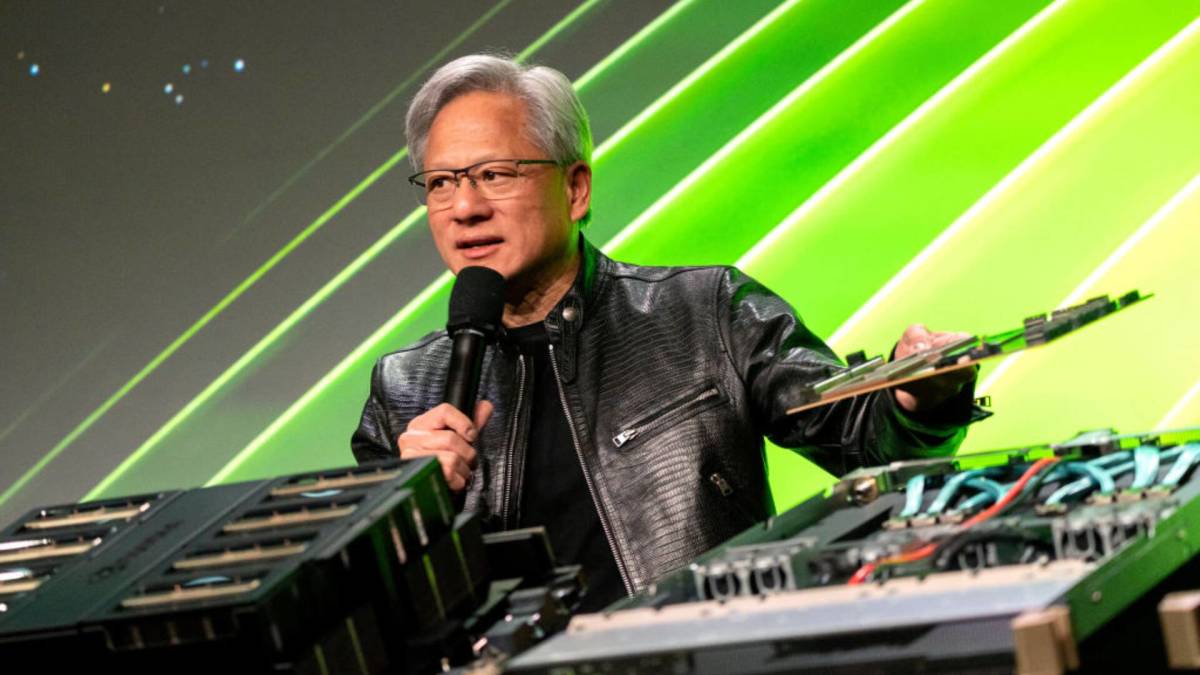

Robbins has a key message for employees a few few particular advantages they may be able to leverage when using these funding instruments in his actually helpful programs. Getty

Tony Robbins clarifies his technique to Roth IRAs vs. Frequent IRAs

Robbins explains that, because taxes on contributions to Roth IRAs are paid up entrance and withdrawals in retirement are made free of taxes, there may be one big reason he recommends folks ought to make investments in Roth IRAs over Frequent IRAs.

Robbins believes that folk's taxes are destined to upward push over the prolonged-timeframe. Many ask that, because they are making much less of an profits in retirement, that will imply they would perhaps be paying lower taxes.

More on Tony Robbins:

- Tony Robbins warns American citizens on Social Safety mistake to handbook positive of

- Philanthropist warns U.S. workers on retirement, Social Safety

- Tony Robbins has blunt phrases on Social Safety and retirement

In his book Cash: Master the Sport, Robbins provides a couple reasons (amongst others) why that's no longer an expectation upon which parents should count.

- In retirement, folks's properties are basically paid off (this capacity that, for tax applications, there may be never any longer any such thing as a mortgage deduction within the market).

- Furthermore, kids are grown up and earn change into taxpayers of their very earn (to permit them to no longer be claimed as dependents).

Connected: Tony Robbins warns U.S. workers on Social Safety, retirement dawdle bet

Tony Robbins has predominant 401(k) advice

Robbins desires to make positive workers are responsive to an likelihood they earn when deciding on a 401(k) knowing of their place of job.

If their employer provides a Roth (401)k, Robbins strongly encourages them to take good thing about it.

For the same reasons as with IRAs, the creator believes that an individual's taxes would perhaps be greater after they retire. Paying those taxes up entrance in a Roth 401(k) — at what would be a lower price — would robotically lead to spending much less money on them (than if they had been no longer ready to make tax-free withdrawals in retirement).

A Heart for Retirement Study record stumbled on that 39% of U.S. households are at possibility of no longer having ample money to protect their present no longer original of residing.

"Reinforcing the notion that roughly half of of households are at threat is the undeniable fact that easiest half of of working households ages 55-64 earn any 401(k)/IRA saving," the record said. "Sure, some earn defined earnings plans, however most with defined earnings plans even earn a 401(k). Furthermore, the amounts in 401(k)s/IRAs are moderately modest, other than the halt quintile of the profits distribution."

Robbins would appear to agree that these warnings are significant reasons for American citizens to make the neatest selections imaginable when deciding on funding ideas for retirement.

Connected: Aged fund supervisor unveils sign-popping S&P 500 forecast

What's Your Reaction?