Top analyst reworks Walmart stock price target ahead of Q4 earnings

Over the past year Walmart shares have outgained all but two of the so-called Magnificent 7 tech stocks, Nvidia and Tesla.

Walmart shares edged increased in early Wednesday trading following a bullish outlook for the sector's best retailer sooner than its fourth quarter earnings document later this week.

The area's best retailer, which continues to snatch an even bigger fragment of increased-earnings consumers because it specializes in preserving costs decrease and bettering e-commerce delivery, has firmly outperformed the broader market, and heaps megacap tech shares, all the plot via the last two years.

Walmart shares possess extra than doubled since spring 2023, while including extra than $400 billion in market cost, following the beginning of an overhaul of its provide-chain costs with a focal level on bettering earnings margins in its grocery and frequent merchandise companies.

The retail huge shall be quietly growing a role of assorted earnings streams, launch air its fundamental sales drivers, which would be producing wider earnings margins and sooner overall progress.

Walmart's e-commerce division is a part of that attention, as is its nascent advertising business, its membership program, and its Walmart Marketplace providing, which esteem Amazon (AMZN) Marketplace permits third-celebration sellers to present their wares on line.

Financial products and companies and success products and companies are also included within the so-called flywheel of assorted earnings streams, named so thanks to their self-perpetuating impacts. Image offer: Jeff Schear/Getty Pictures for Walmart

Morgan Stanley analyst Simeon Gutman argues, in a demonstrate published Wednesday, that those more than just a few earnings streams can possess "extra working leverage than the market appreciates" to force progress in margins and earnings.

Walmart's more than just a few-earnings flywheel

That matter, in fact, changed into as soon as part of the conversation CEO Doug McMillon held with analysts and merchants following Walmart's third quarter earnings document in November.

McMillon talked about the stage of reinvestment within the more than just a few streams remained a "valid-time conversation" for the sector's best retailer.

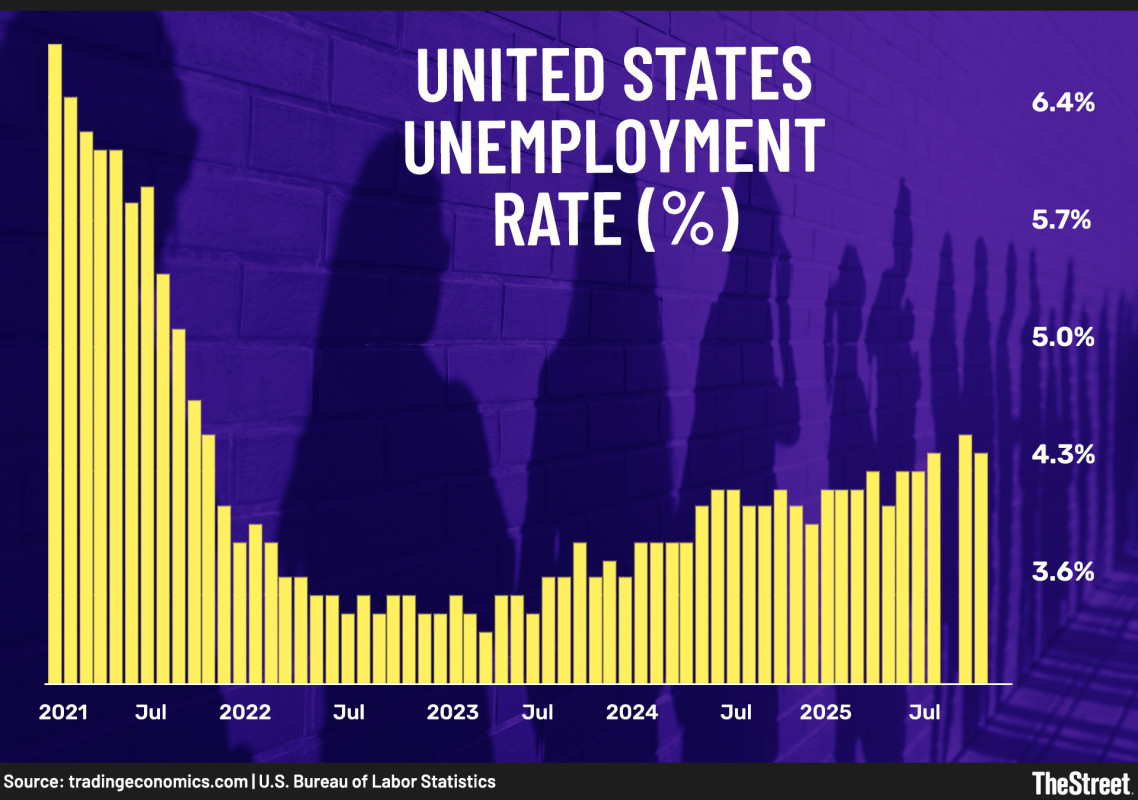

"We bear we're investing the factual amounts, obviously, but it is miles a fluid misfortune," McMillon talked about. "We glimpse designate gaps. We glimpse what's going down within the employment market and possess freedom now to be ready to impress varied investments if we're searching for to.

"So, I bear from a design of an earnings-inform level of be aware, I feel esteem we're being accurately aggressive," he added.

Linked: Walmart sends a laborious-nosed message to workers

Morgan Stanley's Gutman, who reiterated his 'overweight' rating and $115 designate aim on Walmart sooner than Thursday's earnings document, says extra funding may propel margin progress past his bullish estimate of around 12%.

"Walmart has grand extra optionality than perceived," Gutman talked about "It can well resolve to reinvest at an very good sooner price or slither along with the lumber earnings to the backside line."

"While this doesn’t exchange our be aware on medium-term earnings-progress potential (as we can’t predict how grand Walmart will reinvest earnings over time), it affords us extra self perception in its skill to design the more than just a few flywheel that the market is underappreciating," he added.

Walmart grocery and frequent sales soundless growing

Walmart's legacy operations are also performing incredibly effectively, with the community lifting its sales and earnings forecast for a third time closing autumn amid bettering consumer spending and better retailer traffic.

The community estimates that collect sales for fiscal 2025, which ended in January, rose 4.8% to 5.1%, with adjusted earnings within the space of $2.42 to $2.47 a fraction.

For the three months ended in January, analysts estimate Walmart will put up a backside line of 64 cents a fraction, or around $11.12 billion, with earnings rising 3.8% from a 300 and sixty five days earlier to correct over $180 billion.

Linked: Walmart points warning as Trump preps huge tariff hikes

Morgan Stanley's Gutman says the more than just a few-earnings part of Walmart's progress will "make contributions roughly half of of endeavor sales progress and with regards to the complete margin expansion."

As a result, Gutman lifted his bull case designate aim for Walmart inventory by 15%, to $153 a fraction.

"Walmart is clearly in a position to integrating technology that drives effectivity," he talked about. "It is a ways never any twist of fate Walmart's extra than one has been rising [currently about 37.5 times next 12 months price-to-earnings] because the market begins to sense what our mannequin proves."

Walmart shares had been closing marked 0.07% increased in early Wednesday trading and changing hands at $103.85 every, a lumber that can nudge the inventory's 300 and sixty five days-to-date assemble to around 15.4%.

Linked: Used fund supervisor points dire S&P 500 warning for 2025

What's Your Reaction?