Wall Street analyst overhauls S&P 500 price target as markets gyrate

Stocks rebounded from correction last week.

U.S shares are situation for many effective a modest recovery from their run over the rest of the year, a high Wall Avenue investment bank indicated Monday, as traders continue to depend the price of President Donald Trump's tariff and funds-reducing insurance policies to the arena's largest financial system.

The S&P 500 fell into correction territory closing week, after a 10% toddle from its mid-February height dragged the benchmark to its lowest stages since September. The market transfer came amid a global market selloff tied to the uncertainty surrounding Trump's on-yet again, off-yet again tariff threats.

Shares rebounded firmly on Friday, with the S&P 500 recording its strongest pick up of the year, but they remain firmly in the crimson since early January and round 2.5% south of their Election Day finish.

Lori Calvasina, head U.S. strategist at RBC Capital Markets, added to a refrain of analysts who possess trimmed their discontinue-of-year forecasts for the benchmark in a show published Monday. She cited the possibility that slower home enhance and quickening inflation would weigh on earnings enhance.

Calvasina decrease her year-discontinue S&P 500 tag target by 6%, to 6,200 strategies, whereas reducing her collective earnings forecast by round 2.6% to $264 a part.

"We’ve also eradicated the modest [profit-margin] expansion that we had been forecasting," Calvasina stated. “It is a transfer that we mediate is prudent as we suspect this would even be challenging for management teams to devise around the brand new trade protection, which has been in flux.” Bloomberg/Getty Footage

LSEG data, published Friday, label analysts are attempting forward to paunchy-year revenue enhance for the S&P 500 of round 10.6%, down from the 14% forecast that held before everything of the year.

RBC's undergo-case tag target in play?

Calvasina also noted that ought to the S&P 500 retest, or trade by, the lows of closing week, her undergo-case tag target of 5,550 strategies, a 4% discount from her earlier forecast, shall be relief in play.

“Our imperfect-case tag target of 6,200 assumes that the March thirteenth low holds, or that the index won’t fracture noteworthy farther below it. If it does, we mediate our undergo case seemingly kicks in,” she stated.

Unhurried closing week, inclined Wall Avenue forecaster Ed Yarndei trimmed his S&P 500 tag target for this year and subsequent, citing increased recession odds and the dearth of a transfer by Trump to tame the market selloff.

Richard Saperstein, chief investment officer at New York-based Treasury Partners, sees markets closing perilous into early April, when new tariffs on goods from Canada and Mexico, in addition to reciprocal levies on somewhat a couple of U.S. trading companions, kick in.

Related: Stock vigilantes discontinuance the bond market's work in testing financial system

"Markets are gyrating from the aptitude recessionary impacts of tariffs and unsure trade protection," he stated. "The reflects maximum volatility as earnings estimates initiating to near relief down and shopper and trade self belief declines."

CBOE Team's VIX index, which hit a year-to-date high closing week, became as soon as marked at $21.87 in early Monday trading, a diploma that suggests day after day swings of round 1.37%, or 76 strategies, for the S&P 500.

Market corrections 'wholesome': Treasury's Bessent

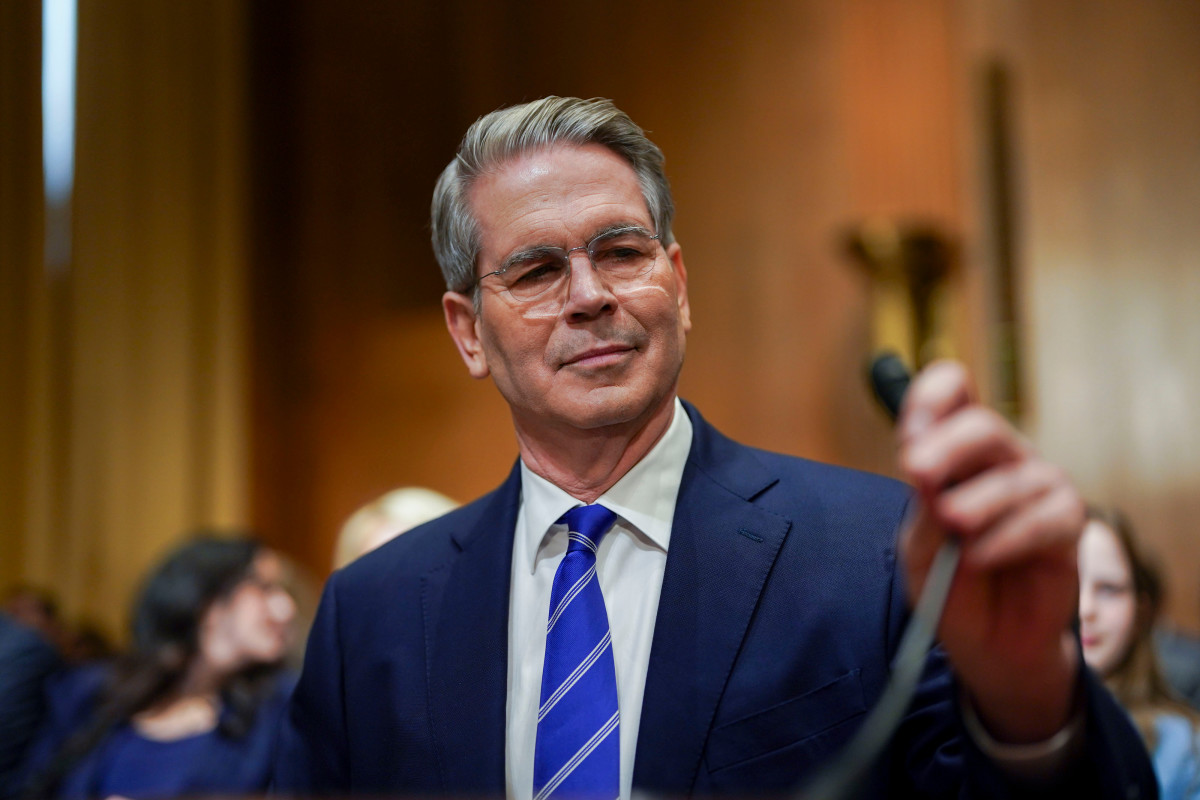

Treasury Secretary Scott Bessent seemed as if it would verify that suspicion at some level of a weekend interview with NBC's "Meet the Press," at some level of which he brushed apart the belief that markets had been signaling difficulty about the president's financial insurance policies.

“I’ve been in the investment trade for 35 years, and I will bid you that corrections are wholesome, they are usual,” Bessent stated. “I‘m no longer unnerved about the markets. "

"Over the future, if we effect good tax protection in space, deregulation and energy security, the markets will discontinuance great,” he added.

Extra Financial Evaluation:

- U.S. shoppers are wilting below renewed stagflation risks

- Jobs experiences present serious possess a study financial system, may roil markets

- Fed inflation gauge signifies big changes in key financial driver

JP Morgan analysts, however, noted that whereas Friday's S&P 500 rally may supply some technical make stronger to the market, "our be aware stays that the enhance fright risks will defend returning, leading to renewed power on equities, capping bond yields and riding one other leg in defensive stock leadership.

"We discontinuance acknowledge that in the very brief term the market may recover a tiny bit, because the S&P 500 is down 10% from highs, many cyclical shares comparable to airways, [capital] goods, banks and also [semiconductors], are down 20% to 30%, and the Bull-Endure has entered oversold territory," Mislav Matejka and his team stated in a show published Monday.

"Having stated that, we discontinuance no longer mediate the air-pocket fright shall be fully total till doubtlessly softer payrolls push the Fed into more principal accommodation."

Related: Dilapidated fund manager unveils take into consideration-popping S&P 500 forecast

What's Your Reaction?