Why your credit card rate may not go down when the Fed cuts rates

Discover what rate cuts mean for your wallet, and what you can do to save money on your credit card debt.

TheStreet aims to feature most efficient one of a few of the most proper services and products. In the event you buy something by technique of one amongst our links, we may earn a commission.

Now that the Federal Reserve has cut interest rates, are you in a position to take a seat up for lower mastercard bills?

While the Fed would now not right away regulate mastercard rates, the coolest news is that changes throughout the Fed funds rate do have some effect on bank cards.

Don't leave out the move: Subscribe to TheStreet's free every day newsletter

The bad news is that mastercard interest rates probably may now now not drop by as a fine deal because the Fed funds rate. Also, the advantages of any drop in mastercard rates may now now not be felt equally by all mastercard customers.

Should you're in search of out a break on the mastercard interest you're paying, there are few things that you just would provide the option to do beyond just waiting for Fed rate cuts. The advantages of those moves may perhaps now now not most efficient improve Fed rate cuts but may exceed those cuts' benefits.

DON'T MISS: Important important points about bank cards

• The manner to dispose of mastercard debt

• Does single mastercard use result in less debt and better credit?

• The manner to begin out building credit

Related: One major mastercard crisis is a growing problem

How will a Fed rate cut have an effect on my mastercard rate?

On Sept. 18, the Federal Reserve announced that it change into cutting the Fed funds rate by 0.5%. To snatch the impact on mastercard rates, call to mind it as a chain reaction. When the Fed funds rate is cut, the bank prime lending rate tends to fall by an identical quantity. Many mastercard rates are according to the prime rate, with an additional amount added.

Beyond this rate cut, the Fed updated its economic projections for the long-term. These projections now show the Fed expects to cut rates again by 0.5% or so by the end of this year, and for rates to fall by an additional 1% by the end of 2025.

This means mastercard rates will likely fall steadily over the next year. Nevertheless it, earlier than consumers get too excited, they should listen on that mastercard rates probably may now now not fall by as a fine deal because the Fed funds rate. And that they'd per chance now now not fall equally for all mastercard customers.

History gives some insight into the connection between Fed rate cuts and mastercard rates.

When the Fed cuts rates, it'd now not most often do it . As a substitute, it makes a series of rate cuts over time. The last two such series of rate cuts were in 2019-20 and 2007-08.

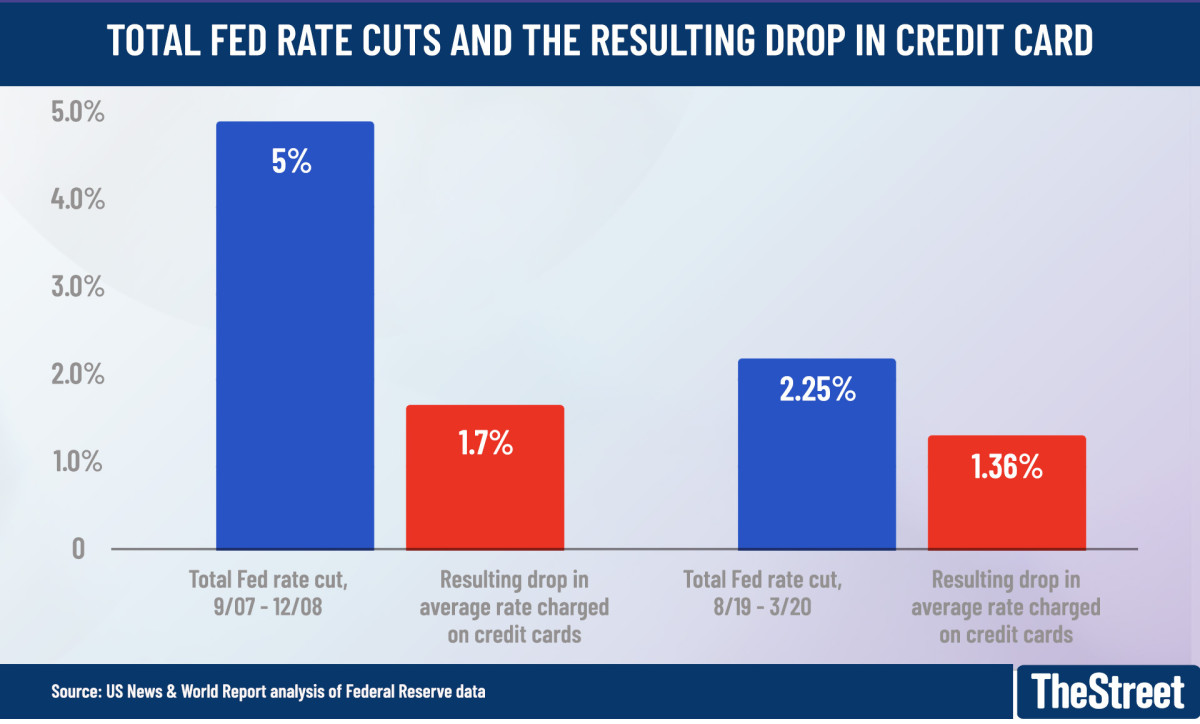

The following chart contrasts the total value of each series of Fed funds rate cuts with the resulting drop throughout the average mastercard rate:

The blue bars throughout the chart show the total size of each of the last two series of Fed rate cuts. The red bars show how a fine deal the average rate of interest charged on bank cards changed in response to those rate cuts.

In each and every case, mastercard rates fell considerably lower than the Fed funds rate. Reason why the Fed funds rate is barely one amongst of the factors mastercard companies agree with when setting rates.

One of the many vital foremost significant factors is credit risk.

"There is a considerable spread between credit rates for folk with good credit and rates for folk with poor credit," explains Martin Gasparian, owner and attorney at Maison Law.

Mastercard rate data from CardRatings.com shows that as of mid-2024, a few bank cards charged rates that were 10% or more higher for folk with poor credit than their rates for folk with excellent credit.

Related: How a fine deal mastercard debt do Americans have on average?

This extra cost for folk with poor credit may get bigger.

"When credit conditions worsen, the spread widens, as lenders give protection to themselves from potential defaults," says Gabe Kahn, director of credit at Arro, a financial literacy web site and mastercard service.

Unfortunately, those conditions have been worsening in most up-to-date months.

Per data from the Federal Reserve Bank of New York, consumer debt is at an all-time high. Similarly, the share of mastercard balances which may perhaps per chance be Ninety days or more overdue is now one of a few of the most proper it truly is been in over a dozen years. Federal Reserve statistics show the bank charge-off rate on consumer credit has been one of a few of the most proper since 2011. Charge-offs represent defaulted payments that lenders have given up taking a look to bring together.

"Rising delinquencies and increased debt are signals that credit conditions would per chance be getting worse," explains Kahn.

These worsening credit conditions may perhaps spark off people with very bad credit scores to pay higher interest rates.

Now and then like these, "Banks will prioritize lending to people with good credit scores at lower rates while increasing the rates for folk with poor credit scores," says Gasparian. Shutterstock

Four methods to pay less mastercard interest

Even with a Fed rate cut, rate of interest reductions on bank cards are in reality now not a sure thing for all customers, specifically those with poor credit. Should you're in search of to pay less interest, here are four things to agree with:

- Shop around. With the Fed having just cut interest rates, that you just would provide the option to in finding that different mastercard companies respond differently. It truly is a glorious time to shop for a more in-depth mastercard APR.

- Improve your credit score. Building a more in-depth credit record will pay off by earning you lower mastercard interest rates. A lot would per chance be gained when rates would per chance be 10% higher or lower, depending for your credit score.

- Pay down your mastercard balance. Of course, how a fine deal your mastercard rate affects you is dependent upon how a fine deal you owe. Reducing your balance should will will will let you pay less interest, whatever rates do.

- Refinance your mastercard debt. If that you just would provide the option to now now not pay down your balance straight away, see in case that you just would provide the option to get a lower rate of interest by refinancing you mastercard debt into a loan or one more card with a lower rate of interest.

The Fed's first rate of interest reduction since 2020 is a positive move for consumers, but at the same time as you may have got mastercard debt, it is able to now now not solve all your problems. There are a type of methods to take matters into your own hands as against just waiting for the next Fed rate cut.

Related: Veteran fund manager sees world of pain coming for stocks

What's Your Reaction?