Analysts revisit Nvidia stock price targets after surprise demand forecast

Nvidia CEO Jensen Huang's GTC address included a shocking outlook for AI computing demand.

Nvidia shares bumped greater in early Wednesday procuring and selling, following the key event of the tech huge's developers' convention the day prior to this, as analysts dug into the keynote address from CEO Jensen Huang and his predictions for the AI funding panorama over the subsequent few yr.

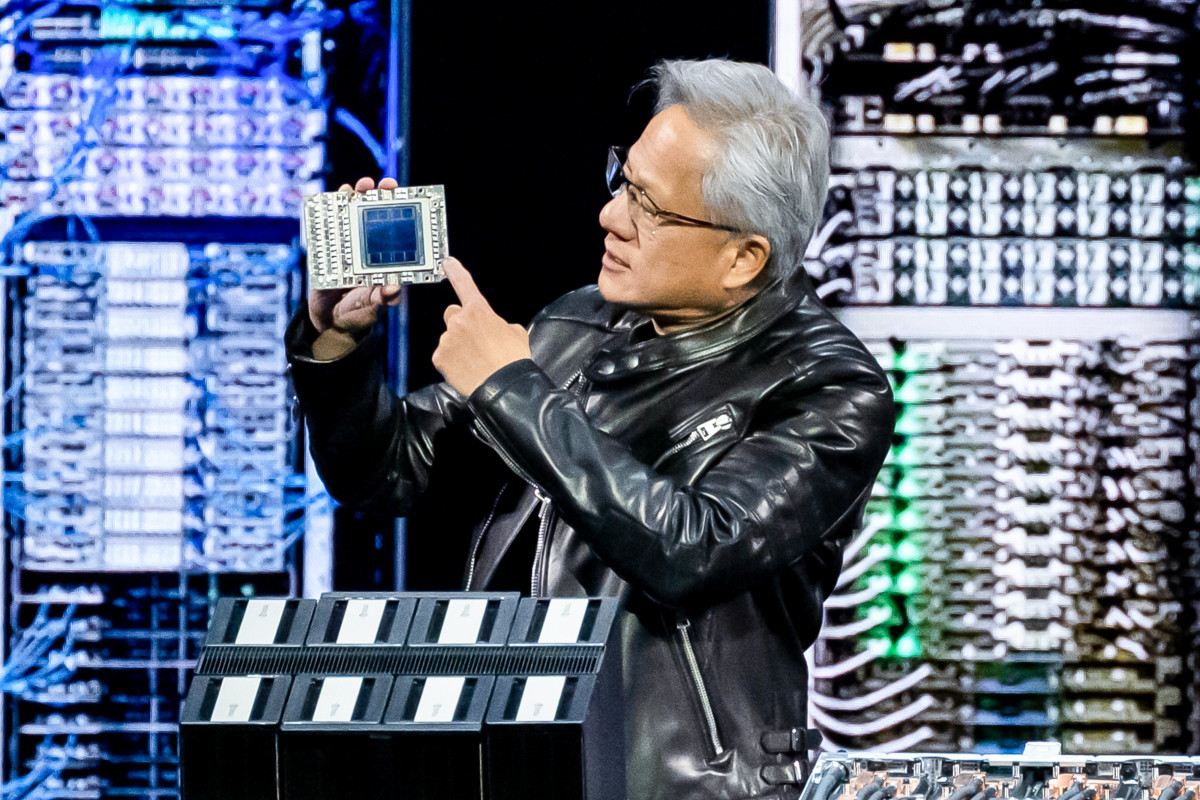

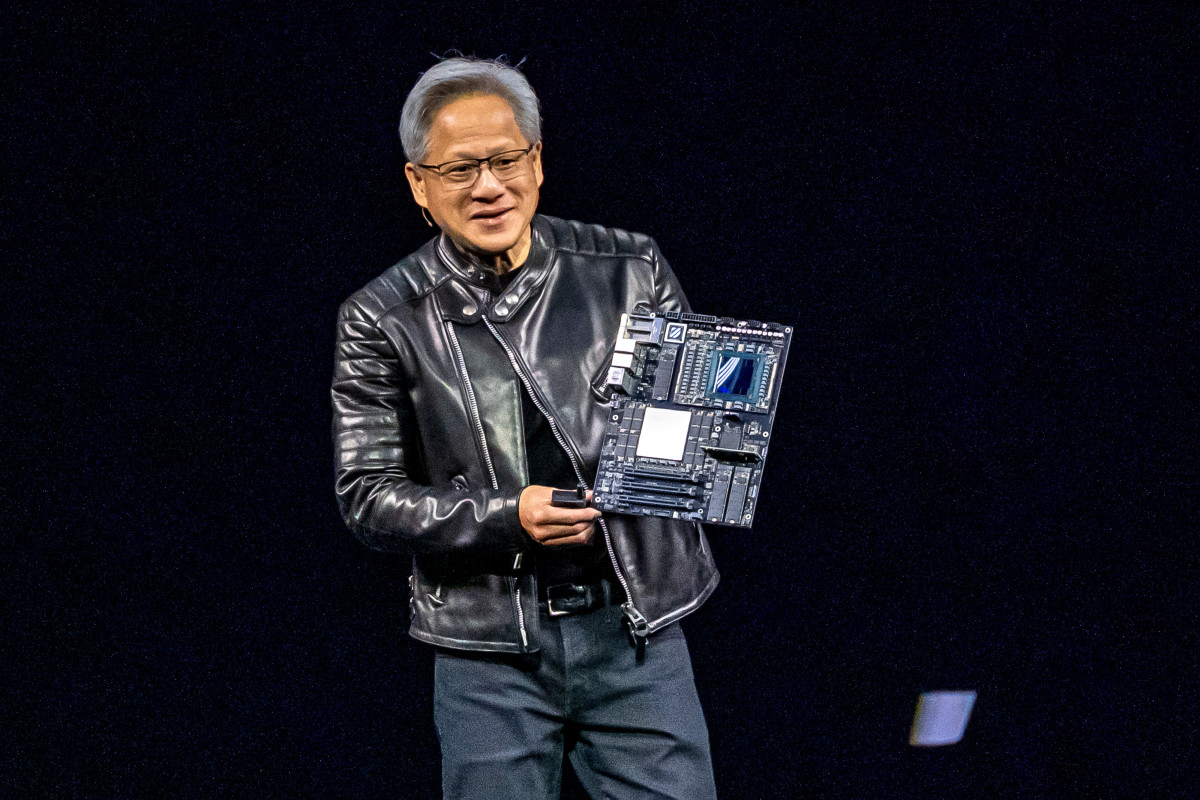

Nvidia's (NVDA) investors looked unmoved by Huang's presentation at the GTC event in San Jose the day prior to this, to boot to the thirty-seven company press releases that followed it, even because the main verbalize for AI trends unveiled a new situation of Blackwell processors and outlined a product enhance roadmap that underscores its unquestioned dominance within the market for the world's freshest skills.

Huang also insisted that the world "received it unfriendly" in their normal review of DeepSeek's emergence earlier this yr, arguing that the China-based startups AI success demonstrates the need for additional, no longer less, computing energy over the approaching years.

"How attain you obtain an algorithm whereby the extra resource you provide, no topic the resource, the smarter the AI turns into," he requested. "The quantity of computation we need at this point on memoir of agentic AI on memoir of reasoning is with out snort a hundred instances extra than we idea we wished this time closing yr." Bloomberg/Getty Images

That need, Huang acknowledged, will likely require around $1 trillion of information heart investments by 2028, a staggering tally that should underscore both request for its new and existing line of AI processors to boot to its capability to divulge greater costs and never more assailable profit margins.

Nvidia line-up extends to 2028

To meet that request, Nvidia unveiled its new line of Blackwell 'ultra' processors, that are expected to ship later this yr, with extra than 1.5 instances the computing energy of the no longer too long ago-launched Blackwell.

Following on from that, Huang acknowledged, would be the slack 2026 unlock of the subsequent-generation Rubin line, that can reach within a so-called server rack of 114 processors, double that of Blackwell, nevertheless with 3.3 instances the energy and functionality.

A extra iteration, Nvidia Feynman (named after the American theoretical physicist Richard Feynman) will near in 2028, Huang acknowledged.

Connected: Nvidia CEO Jensen Huang may reboot AI replace with GTC address

"It remains to be Nvidia's sport to lose - and they don’t seem like dropping," acknowledged Bernstein analyst Stacy Rasgon, who reiterated his $185 Nvidia worth goal following closing evening's GTC keynote.

"Nothing (within the speech) hugely drastically surprised, given the total pre-event speculation, nevertheless we restful idea it sounded good," Rasgon acknowledged. "The roadmap appears actually loyal, and their functionality hole vs. opponents all over their whole huge stack continues to widen."

Bank of The US Vivek Arya, who held his $200 worth goal and 'aquire' rating in situation, also acknowledged the speech, to boot to briefing from finance chief Colette Kress, "demonstrates Nvidia is continuing to deepen its aggressive moat in a $1 trillion-plus infrastructure/companies total addressable market."

"Overall, Nvidia continues to dominate the AI cost chain with its elephantine-stack turnkey (hardware, application, systems, companies, developers) model," Arya acknowledged.

Computing energy wants power request

Cantor Fitzgerald analyst C.J. Muse, who carries a $200 worth goal and 'chubby' rating on Nvidia stock, acknowledged the key factor of Huang's address was the key address computing wants and the company's capability to meet it with new merchandise and applications.

"On the crux of the whole lot here is Nvidia’s work in combining its best-in-class hardware with application initiatives, such because the newly offered Dynamo application stack that acts because the working map for AI factories, and when mixed with Blackwell affords ~40x inference development vs. the prior-generation Hopper," he acknowledged.

"No longer to claim the roadmap the company laid out with the subsequent 3 generations of product choices, which lift along meaningful performance advantages," he added.

Connected: Nvidia's put up-earnings skedaddle highlights key probability

Wedbush analyst Dan Ives, within the meantime, centered on the impact Nvidia's advances will have all around the broader tech sector, estimating that for every and each $1 spent on a Nvidia chip, 'there could be a $8 to $10 multiplier all around the tech ecosystem", along side 'hyperscalers, application, info heart buildouts, cyber security, and energy request."

"In essence, Nvidia's chips remain the brand new oil or gold on this world for the tech ecosystem as there may be best one chip within the world fueling this AI foundation - and its Nvidia," he added.

Monetary apply-up

Nvidia plans to spend-up on Huang's address with a financial Q&A session later this morning at 11:30 am jap time.

Last month, Nvidia topped Wall Twin carriageway forecasts with fourth quarter revenues of $39.3 billion and dealing profits of around $25.52 billion.

Revenues from its key info heart section, which properties the chips and processors that energy AI systems for shoppers equivalent to Meta Platforms (META) , Microsoft (MSFT) , Amazon (AMZN) and Google mother or father Alphabet (GOOGL) , nearly doubled from closing yr to $94.5 billion.

Extra Nvidia:

- Nvidia's huge tech convention will bid their comprise praises AI's future

- Fund supervisor sends blunt message on Nvidia stock sooner than convention

- Analysts turn heads with Nvidia stock worth goal transfer

Blackwell revenues, within the meantime, got here in at $11 billion, a mighty stronger-than-expected total for the brand new line of processors which had been beset by reports of underwhelming performance and provide chain constraints.

Nvidia also acknowledged sees present-quarter revenues rising one more 10% sequentially, to around $43 billion, amid what the company described as "swiftly rising request for AI reasoning devices and brokers."

Nvidia shares were closing marked 1.3% greater in premarket procuring and selling to point a gap bell worth of $116.92 each and each.

Connected: Damaged-down fund supervisor unveils sight-popping S&P 500 forecast

What's Your Reaction?