Is AMD Stock About to Bounce? Here’s the Setup.

AMD stock has declined in 8 of the past 9 trading sessions but is coming into a major support level. Here's how to trade it now.

AMD stock has declined in 8 of the past 9 trading sessions but is coming into a major support level. Here's how to trade it now.

Semiconductor stocks like Advanced Micro Devices (AMD) - Get Free Report and Nvidia (NVDA) - Get Free Report have helped lead the charge in tech stocks, a group that's buoyed the overall market this year.

But lately AMD has been on the decline.

The chip stalwart's stock is working on its fifth straight daily decline and ninth decline in the past 10 sessions.

While the shares remain 39% higher so far this year, they're down roughly 7% over the past month.

Don't Miss: Here's Where Microsoft Stock Needs to Hold Support on a Pullback

AMD stock has performed well this year — trouncing the gains in the S&P 500 and Nasdaq — it lags the gains in Nvidia stock.

Nvidia is up fully 83% this year and is 5% higher over the past month after a minor dip last week.

The disparity between the two likely comes amid the AI revolution, as Nvidia is viewed as the clear GPU leader in the business.

Still, the recent action in AMD should have the bulls looking for a potential buy-the-dip setup.

Trading AMD Stock

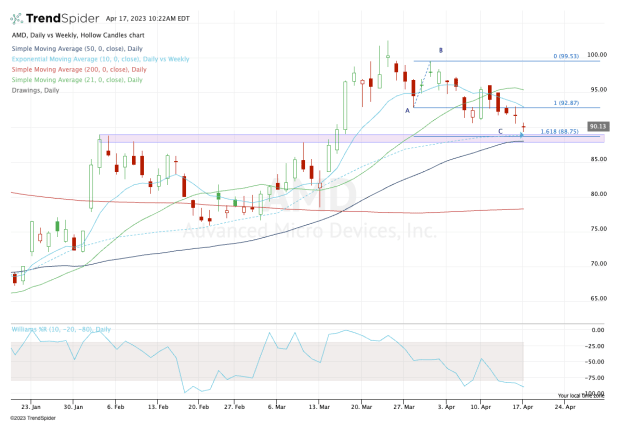

Chart courtesy of TrendSpider.com

Looking at the daily chart above, we see an ABC type correction (as annotated on the chart) down into the upper-$80s.

The bulls should be looking for support around $89. In this zone, the stock finds its 10-week and 50-day moving averages, as well as the 161.8% downside extension of the current correction and a prior breakout zone from February and March.

Notice how the 50-day moving average hasn’t been tested since AMD broke above this mark in late January, while the 10-week moving average has been pretty steady support.

For these reasons, buyers have a buy-the-dip approach.

Don't Miss: How Far Can JPMorgan Stock Rally on Earnings?

On the upside, let’s see if the stock can regain the $92.50 to $93 area. If it can do so, $95.50 to $97 could be in play next, followed by the $100 level.

If we zoom out, we know that the $99 to $100 zone has been a significant support/resistance level for AMD stock in the past, so it’s a major hurdle at the moment.

On the downside, a break of the 50-day moving average could usher in a test of the $86 level, followed by the $81 to $82 zone.

For now, though, the bulls remains in control of the current trend.

Get investment guidance from trusted portfolio managers without the management fees. Sign up for Action Alerts PLUS now.

What's Your Reaction?