Stock Market Today, Feb. 3: Software stocks landslide after PayPal's poor earnings; Nasdaq falls 1%

This live blog is refreshed periodically throughout the day with the latest updates from the market.To find the latest Stock Market Today threads, click here. Happy Tuesday. This is TheStreet’s Stock Market Today for Feb. 3, 2026. You can follow the latest updates on the market ...

This live blog is refreshed periodically throughout the day with the latest updates from the market.To find the latest Stock Market Today threads, click here.

Happy Tuesday. This is TheStreet’s Stock Market Today for Feb. 3, 2026. You can follow the latest updates on the market here in our daily live blog

Update: 9:40 a.m. ET

Opening Bell

The U.S. market is now opened for the day. At present, today is fixing to be a continuation of yesterday's moves: the Russell2000 (+0.57%) and Dow (+0.14%) leading the way, while the S&P 500(-0.15%) and Nasdaq (-0.55%) lag the small cap and megacap index.

In fact, the latter two indexes have put together back-to-back-to-back red candles, perhaps auguring what today's trading will look like. The reaction seems to have most to do with poor results from software company PayPal this morning. Despite that, 59.9% of U.S. equities are advancing this morning, even as large cap indexes are struggling to put up a performance --- continuing the recent string of outperformance.

In commodities, continuous contracts in gold (+6.19% to $4,940.60) and silver (+14.36% to $88.07) are back today, resuming their upwards trajectory after substantial declines in the last few trading days. Natural gas (+3.512% to $3.351) and Brent crude oil(+0.69% to $66.76) are also advancing.

Rounding things out, the 10Y Treasury is steady, up 0.6 bips to 4.283%.

Heatmap: S&P 500

This morning, a healthy portion of the S&P 500 index is in the green, led by the materials (+2.16%), energy (+1.13%), and utilities (+0.89%) sector. Pulling down the S&P 500 is declines in technology (-0.83%) and communication services (-0.42%).

Despite not being a top performer, consumer defensive is also a point of strength today. Walmart (+0.85%), which has added nearly one percent in its opening minutes of trading today, just eclipsed a $1 trillion market cap for the first time. That's a big milestone for the wholesale giant.

As aforementioned, the wholesale declines appear to be coming out of software firms, while other pockets of the semiconductor and hardware business are seen advancing. Palantir(+6.52%), which reported earnings after the market close yesterday, is a somewhat rare exception among software names today.

Here is the morning heatmap:

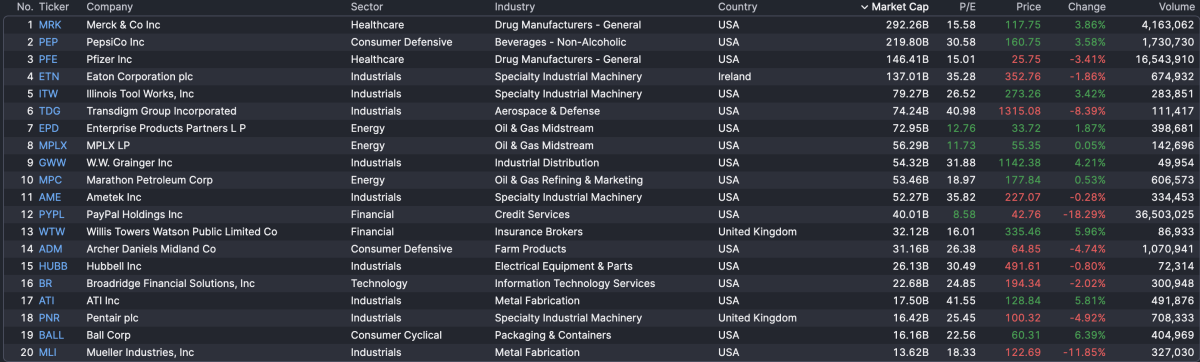

Earnings Today: Advanced Micro Devices, Merck, PepsiCo

This morning saw a series of large reports, including Merck, PepsiCo, and Pfizer, among others. Among larger reports from the pre-market, PayPal (-18.29%) is the largest decliner among this morning's earnings, on track for its second-worst day of trading ever. On the other hand, Ball Corp (+6.39%) is the biggest advancer today.

The megacap reports will continue after the market closes this evening, led by Advanced Micro Devices and

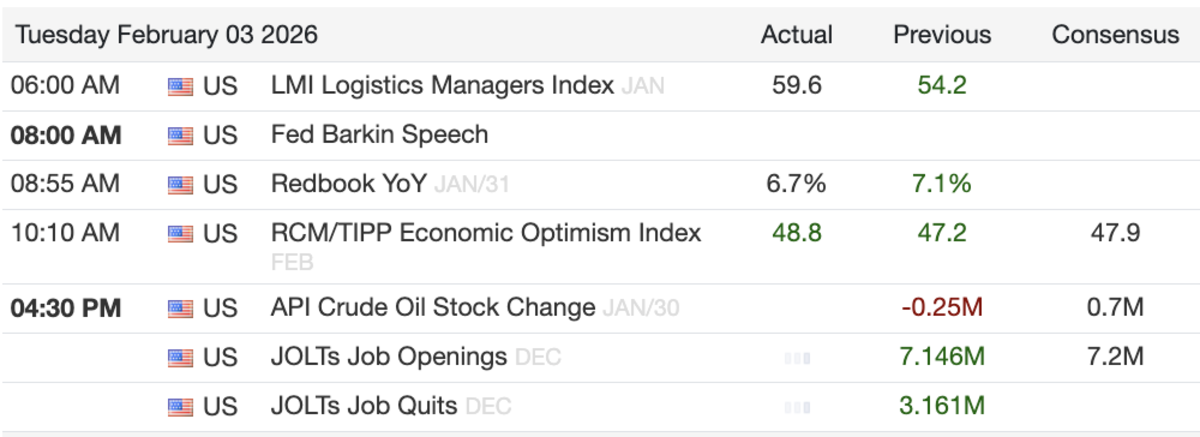

Economic Events: LMI Logistics, Redbook, RCM/TIPP Economic Optimism Index

This morning's slate of economic data included positive results from the LMI Logistics Managers Index (59.6), Redbook (+6.7% YoY), and RCM/TIPP Economic Optimism Index (48.8). Here is the slate:

Also notable, JOLTS was rescheduled as a result of the partial government shutdown. It will be rescheduled for a few weeks from now.

What's Your Reaction?