U.S. Government Shutdown: 5 ETFs To Consider Buying (And One To Avoid)

Here's how to consider positioning your portfolio for a prolonged shutdown.

The U.S. government officially shut down at midnight on September 30th, marking the first time this has happened since 2019.

Many investors worry about how their portfolios might react during government shutdowns. With some agencies shuttered and several economic reports delayed, there are often concerns that the lack of transparency could cause market volatility. Periods of elevated volatility often correlate with declines in equity prices.

History of U.S. Government Shutdowns

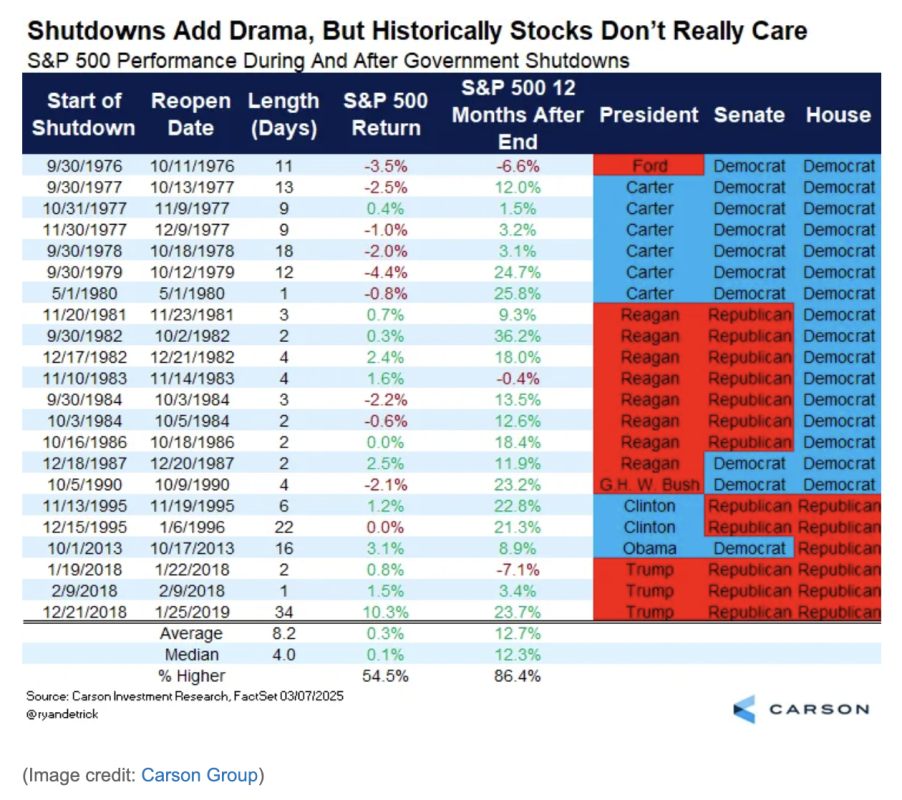

Historically, that mostly hasn’t been the case. According to Carson Group research, there’s really no consistent pattern in how the S&P 500 performs during shutdowns. Index returns also tend to be relatively minor.

Keep in mind that, historically, shutdowns are usually very short, often lasting just a few days and rarely more than two weeks. That gives the financial markets little time to react, and conditions usually return back to normal as soon as the shutdown ends. Investors are aware of this and usually will not overreact to shutdowns.

In 2025, however, both sides seem to be dug in on their respective positions. On one side, Democrats are pushing for healthcare reform. On the other side, Republicans are talking about the potential for permanent federal employee layoffs if the shutdown drags on.

Related: Bank of America revamps S&P 500 target for the rest of 2025

With the two parties appearing to be far apart on reaching common ground at this point, this shutdown may turn out to be one of the longer ones of the past 50 years.

ETFs to consider buying for a prolonged government shutdown

Considering how a lengthier shutdown could impact your portfolio could be wise. Taking some risk off the table until the dust settles could also make sense if the market grows restless and volatility picks up.

Here are five ETFs to consider if you’re looking to position yourself more defensively:

- SPDR Gold MiniShares ETF (GLDM): This is the much cheaper version of the popular SPDR Gold Shares ETF (GLD). Gold often acts as a safe haven during times of uncertainty, both economically and politically. Central bank buying has led to a huge gold rally in 2025, and a government shutdown could increase demand further.

- iShares 3-7 Year Treasury Bond ETF (IEI): Treasuries also often act as a risk-off asset in challenging times. The Fed is likely to continue lowering rates over the next 9-12 months, which should contribute as a tailwind. Staying with intermediate-term maturities helps provide some share price potential but not enough to put your principal at significant risk should yields move the other way.

- Vanguard Utilities ETF (VPU): Utilities are generally considered one of the least risky areas of the equity market due to their regulated nature and constant, steady demand for basic electricity and water services.

- iShares MSCI USA Minimum Volatility Factor ETF (USMV): As the name suggests, this fund invests in traditionally defensive equities that could fall less should equities begin declining. Top holdings currently include McKesson Corp, IBM and ExxonMobil.

- AGF U.S. Market Neutral Anti-Beta ETF (BTAL): BTAL is a long/short fund that invests in low volatility stocks while simultaneously shorting high beta stocks. Because of this, it often works best as a volatility hedge that can produce positive returns in any market environment so long as low vol is outperforming high beta.

These five ETFs represent different ways to position a portfolio more defensively and are likely to have different risk/reward profiles depending on how the market reacts to the shutdown.

Equity ETFs, such as VPU and (USMV) , are still invested in stocks, however, and could experience substantial downside. Gold, Treasuries and alternatives often have low to negative correlations with equities and could help reduce overall portfolio risk.

One ETF to Consider Avoiding During The Shutdown

There are some sectors which could be negatively impacted more than others during a government shutdown. Those with closer ties to the government or those whose revenue streams are more reliant on government contracts could be particularly at risk.

Therefore, the iShares U.S. Aerospace & Defense ETF (ITA) might be one to consider staying away from. Some of the biggest defense companies, including Boeing, Lockheed Martin and Northrop Grumman, may derive half of their revenue or more just from U.S. defense contracts.

A government shutdown could disrupt and potentially delay payments for those contracts. Any question about the reliability of these revenue streams could cause investors to shy away.

Final Thoughts

- Historically, government shutdowns are usually short-term, resulting in little disruption to U.S. equity markets.

- It’s understandable that some investors may want to reduce their risk exposure if the current shutdown appears likely to last indefinitely.

- Using the above ETFs to shift your portfolio exposures could help investors ride out a potentially uncertain outcome.

Related: Government shutdown threatens stock market rally

What's Your Reaction?