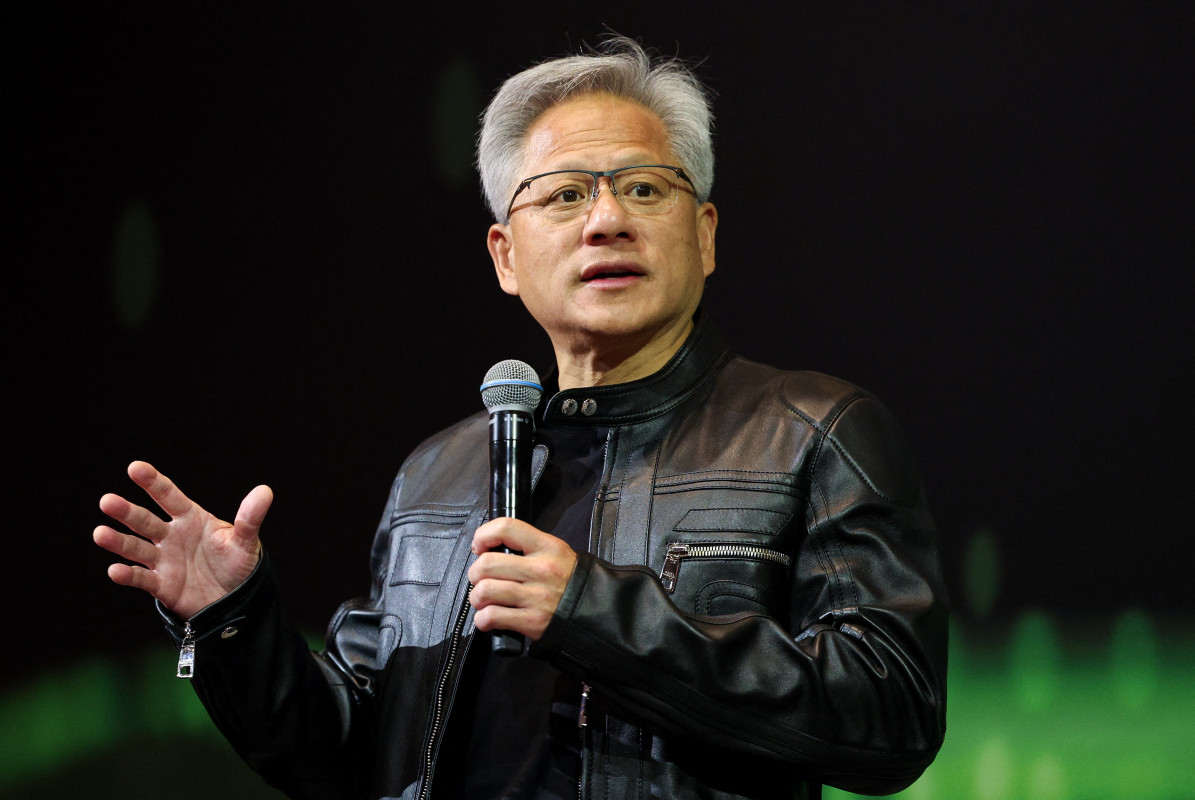

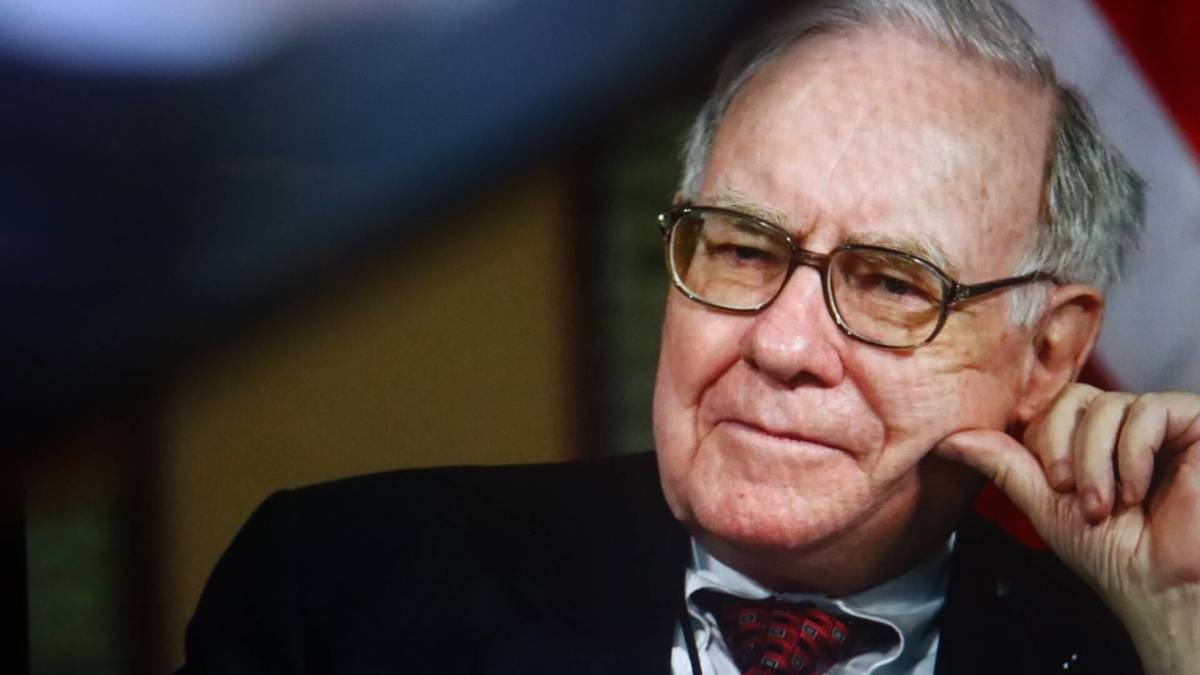

Warren Buffett reaches a milestone Berkshire investors waited decades for

I was scrolling X when a post stopped me cold. “BREAKING: Tomorrow is Warren Buffett's last day as CEO of Berkshire Hathaway. Buffett took the stock from $19/share in 1965 to $750,000/share today, up +3,950,000%. Congratulations to the best investor of all time.” That is how The Kobeissi Letter, a ...

I was scrolling X when a post stopped me cold.

“BREAKING: Tomorrow is Warren Buffett's last day as CEO of Berkshire Hathaway. Buffett took the stock from $19/share in 1965 to $750,000/share today, up +3,950,000%. Congratulations to the best investor of all time.” That is how The Kobeissi Letter, a widely followed macro and markets account, chose to mark Buffett’s final day as Berkshire’s chief executive.

In three short sentences, Kobeissi compresses a 60-year run into a before-and-after price, a jaw-dropping percentage, and a verdict on Buffett’s place in investing history. The numbers are not marketing spin: Berkshire’s Class A shares recently traded above $750,000 for the first time, with Business Insider reporting an intraday high near $760,000 and a market value around $1.1 trillion, up from roughly $19 per share when Buffett took control in 1965.

For you as an investor, the tweet is more than a viral moment. It is a prompt to ask what got Berkshire to this milestone, what changes when Buffett steps back, and whether owning the stock still makes sense in a post-Buffett era.

How Berkshire went from $19 to $750,000

Kobeissi’s tweet highlights the start and end points, but the journey in between is where the real lessons live.

According to Berkshire’s own history and coverage compiled by outlets like Yahoo Finance and Business Insider, Buffett took over a struggling New England textile mill in 1965 and gradually transformed it into a diversified conglomerate anchored by insurance, railroads, utilities, manufacturing, retail, and a giant portfolio of public stocks. Shuttetstock

Along the way, he used insurance “float” from units like Geico and General Re to invest in everything from Coca-Cola and American Express to, more recently, Apple, effectively turning Berkshire into a compounding machine that reinvested profits again and again instead of paying them out as dividends.

Business Insider reported that Berkshire’s Class A stock first hit $100,000 in 2006, about 41 years after Buffett took charge, then added another $700,000 in under two decades, including a sprint this year where the shares gained roughly $100,000 in just 37 trading days. Those moves pushed total returns since 1965 into the multi-million-percent range, a performance record Morningstar and others say has roughly doubled the S&P 500’s annualized return over the same span.

More Warren Buffett

- Warren Buffett’s Berkshire Hathaway shares mortgage warning

- Analysis: Why ‘cheap stocks to buy now’ is the wrong investing idea

Buffett himself has long argued that the high sticker price is intentional. In past shareholder letters and meetings, cited by Market Insider, he explained that avoiding stock splits kept day traders and speculators away and attracted what he calls “high-quality shareholders” who think like partners, not gamblers. The Kobeissi tweet throws that philosophy into sharp relief: the price per share is now a billboard for nearly six decades of compounding.

Tomorrow really is Buffett's last day as CEO

According to Yahoo Finance, tomorrow marks Warren Buffett’s final day as CEO of Berkshire Hathaway after roughly 60 years in the role, with vice chairman Greg Abel set to become chief executive on January 1. Buffett, now in his mid-90s, will remain as chairman and has told shareholders he will “hang around” and “could be helpful in certain respects,” but he has been very clear that “the final word would be with Greg on operations, capital deployment, and acquisitions.”

Reuters reported earlier this year that Berkshire investors largely welcomed Abel’s elevation, describing him as a disciplined operator who has already overseen most of the non-insurance businesses since 2018, but they also acknowledged that it will be difficult for anyone to inspire the same level of enthusiasm that Buffett and longtime partner Charlie Munger did.

Hanson also told Reuters he has “complete faith in Greg’s leadership.”

That smooth handoff is exactly why most analysts are not expecting sudden, dramatic changes on day one. Still, for your portfolio, this is a genuine regime shift: the person making the final capital allocation calls is new, even if the culture and playbook will sound familiar.

Berkshire after Buffett: what changes for your money

As he hands the reins to Abel, Buffett is leaving behind a company with roughly $380 billion in cash and short-term investments, according to recent estimates cited by Yahoo Finance, plus around $270 billion in public equities and more than 180 operating businesses spanning insurance, railroads, energy, manufacturing, retail, and services.

Berkshire’s market value sits near $1.1 trillion, and yet its stock trades at a more modest valuation than many of the AI-driven mega caps that dominate headlines.

Here are my three practical questions for you to ask yourself as you absorb Kobeissi’s headline and think about your own portfolio:

- Are you buying the Buffett story or the Berkshire machine? Buffett will remain involved as chairman, but the operating decisions and big capital-allocation calls will increasingly be Greg Abel’s. If your conviction rests entirely on Buffett’s name, you may need to recalibrate.

- How do you feel about a massive cash pile in an expensive market? Berkshire’s tens of billions in cash have long been a source of frustration for some shareholders, but they also give Abel enormous flexibility if valuations fall or distressed opportunities emerge.

- Do you want a “boring” compounder or higher-octane growth? Analysts quoted by AOL generally expect Berkshire’s returns to moderate toward the market average over time, but they still see it as a steady, diversified vehicle for long-term wealth building.

Related: Warren Buffett's Berkshire Hathaway forecasts real estate shift

If you are a long-term, buy-and-hold investor, Berkshire’s combination of conservative balance sheet, diversified earnings, and a management team steeped in Buffett’s philosophy can still make it a core holding, even if the days of multi-million-percent gains are in the rearview mirror.

If you are chasing quick, AI-style upside, the stock’s recent 2025 rally into record territory may not fit the kind of risk-reward profile you are looking for.

How to use this milestone as a personal finance lesson

The jump from $19 to $750,000 is really a story about patience, discipline, and the power of compounding more than it is about any single brilliant trade. Buffett avoided overpaying, shunned complex derivatives and high leverage, stuck to businesses he understood, and let time do the heavy lifting, a playbook that ordinary investors can follow in index funds or in carefully chosen individual stocks.

If you are early in your investing journey, the tweet is a reminder that the most important decision is to start and stay consistent, not to find the next Berkshire on day one. If you are further along, it is a nudge to examine your own holdings and ask which ones you would be comfortable owning through leadership changes, recessions, and trend shifts the way Buffett’s long-term partners owned Berkshire.

Related: Warren Buffett's Berkshire Hathaway forecasts real estate shift

What's Your Reaction?