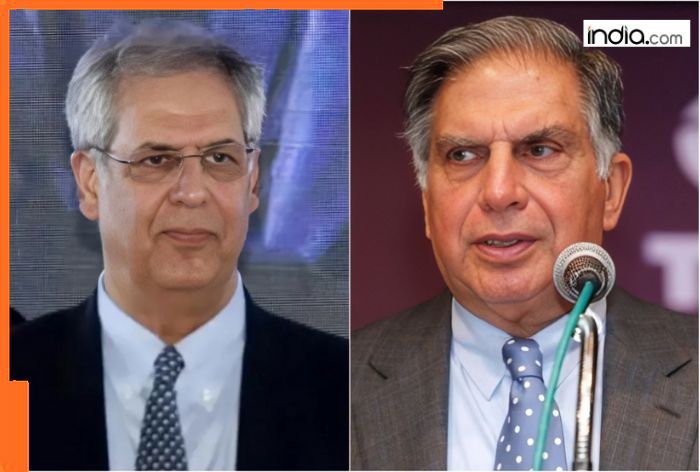

Ratan Tata death anniversary: How Tata International’s Rs 1,000-crore funding decision deepened rift among Tata Trusts Trustees, Noel Tata’s role was…

Noel Tata's Tata International Limited (TIL) has been at the realm of a Rs 1,000-crore funding decision that deepened rift among Tata Trusts Trustees.

New Delhi: A new controversy has emerged in the saga of growing discord within the Ratan Tata’s Tata Trusts. Sparked by a proposed funding plan for Tata International Limited (TIL), the controversy has grown into a full-fledged corporate war. The capital raise of approximately Rs 1,000 crore has sparked allegations of inadequate consultation within the trusts and a violation of Article 121A of Tata Sons, an article requires the trusts’ prior approval for any major financial decision. Therefore, the proposed funding plan for loss-making Tata International Ltd has led to a growing discord within the Ratan Tata’s Tata Trusts.

What is the controversy at Ratan Tata’s Tata Trusts?

Noel Tata, the chairman of the Tata Trusts, Trent and Tata Investment Corporation who has been leading TIL since 2010 and has been associated with the company for two decades, views the company as a vital bridge between the Tata Group’s domestic and international businesses. Spread across 27 countries, the company operates in auto distribution, leather exports, agri-trading, and industrial supply chains. However, the company is grappling with challenges such as a high debt burden, foreign exchange losses, and a weak growth model.

Why are trust members opposing the funding process?

According to media reports, trust members Pramit Jhaveri, Mehli Mistry, Jehangir H.C. Jahangir and Darius Khambatta questioned the funding process at a board meeting held on September 11. According to media reports, “The issue isn’t whether TIL needed the funding, but rather how the decision was made.” The dissenting trustees believe that such a major financial decision warranted extensive prior discussion and information sharing.

Furthermore, these trust members cited the recent example of Tata Motors’ €3.8 billion (approximately Rs. 38,000 crores) acquisition of IVECO Group’s non-defense commercial vehicle business, in which they were only informed at a late stage. These developments are sparking renewed debate within trusts about decision-making, transparency, and the importance of prior approval.

What's Your Reaction?