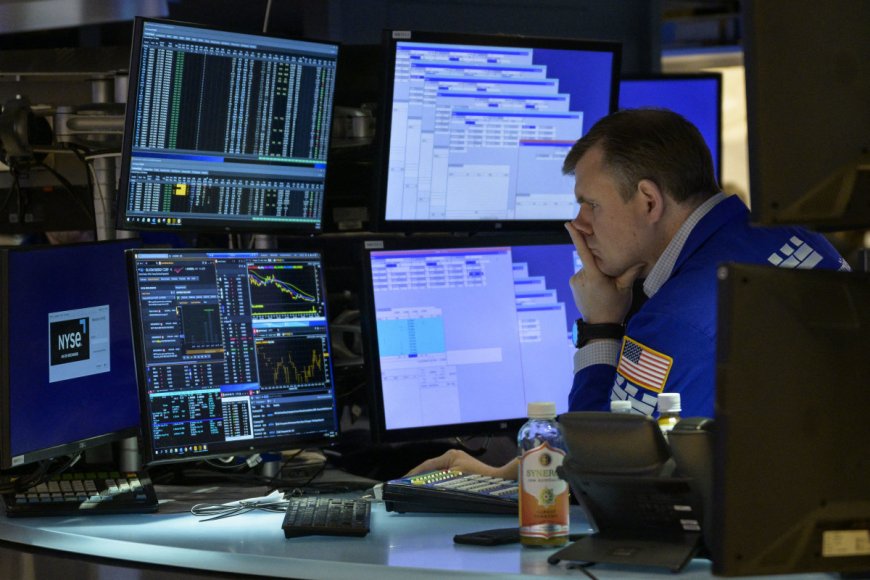

Stock Market Today: Stocks slip lower into 'triple witching hour'

U.S. stocks are on pace for another weekly gain following a series of tech-powered records for the S&P 500.

Check back for updates throughout the trading day

U.S. equity futures nudged lower Friday, while the dollar held at multiweek highs against its global peers, as investors looked to a key reading of domestic economic activity to revive the recent tech-led rally.

Updated at 9:02 AM EDT

Apple AI boost

Apple shares are edging higher in premarket trading, and look set to resume their place as the market's second biggest stock, following an early Friday price target upgrade from Bernstein analyst Toni Sacconaghi.

Apple shares were last marked 0.85% higher at $211.47 each, a move that would extend their year-to-date gain to around 15%.

Related: Top analyst revisits Apple stock price target following AI push

Stock Market Today

Stocks ended modestly lower Thursday after a pullback in Nvidia (NVDA) , which briefly assumed the title of world's most-valuable stock, lost momentum toward the end of the session and pulled both the S&P 500 and the Nasdaq lower over the final hours of trading.

Megacap-tech moves will be key to the market's performance again today, although investors will also be closely tracking S&P Global's benchmark PMI reading for the month of June. That report is expected to show a modest pullback in both services sector and manufacturing activity while still indicating solid overall expansion.

Related: Housing market seeks Fed rate-cut relief as sales slump

The Atlanta Fed's GDPNow reading in fact was trimmed late Thursday to a current-quarter growth rate of 3%, still more than double the official pace recorded over the first three months of the year.

Markets will also keep a close eye on the impact of the so-called triple witching hour, a quarterly event that sees the expiry of options on equity indexes, exchange-traded funds and futures.

Around $5.5 trillion in options are set to expire Friday in a move that could ignite the market's key volatility index, CBOE Group's VIX, over the the coming days.

The VIX was last marked 7.8% higher in early trading at $13.45, suggesting traders expect daily swings for the S&P 500 of around 0.84%, or 46 points, over the next 30 days.

Heading into the start of the trading day on Wall Street, futures contracts tied to the S&P 500, which is up 4.16% for the quarter, are priced for a 10-point opening-bell decline.

The Dow Jones Industrial Average, meanwhile, is called 63 points lower while the tech-focused Nasdaq is set for a 46-point pullback.

Stocks on the move include Nvidia, which is down another 1.7% in premarket trading following last night's 3.5% slump, as well as chipmakers Advanced Micro Devices (AMD) and Micron Technology (MU) , which are down 0.9% and 1.3% respectively.

Related: Nvidia has $4 trillion value in sight as AI seen powering chip sales

In Europe, the regionwide Stoxx 600 was marked 0.87% lower in Frankfurt, but is still on pace for a modest weekly gain. Britain's FTSE 100 was down 0.84% following yesterday's Bank of England rate decision.

More Wall Street Analysts:

- Analyst updates Oracle stock price target after earnings

- Analyst reboots Trade Desk stock price target after Netflix deal

- Analysts adjust Micron stock price target ahead of earnings

Overnight in Asia, Japan's Nikkei 225 ended 0.09% lower on the day, snapping a three-day win streak, and ended the week with a 0.49% decline.

The regionwide MSCI ex-Japan benchmark was down 0.8% into the final hours of trading with declines across the board in China, Hong Kong and South Korea.

Related: Veteran fund manager picks favorite stocks for 2024

What's Your Reaction?