What Medicare Part B price hike means for your 2026 Social Security

The sting is a bit less than estimated. But it’s a substantial sting nonetheless. The Centers for Medicare & Medicaid Services announced late on Nov. 14 that Part B premiums would rise $17.90 or 9.6% to $202.90 per month from $185 in 2025. The 2025 Medicare Trustees report released earlier this ...

The sting is a bit less than estimated.

But it’s a substantial sting nonetheless.

The Centers for Medicare & Medicaid Services announced late on Nov. 14 that Part B premiums would rise $17.90 or 9.6% to $202.90 per month from $185 in 2025. The 2025 Medicare Trustees report released earlier this year projected that the standard monthly Medicare Part B premium could rise to $206.50 in 2026.

Still, the percentage increase in the standard monthly Part B premium for 2026 is more than three times the 2.8% increase Social Security’s cost-of-living adjustment for 2026, Rhian Horgan, founder and CEO of Silvur, wrote on LinkedIn.

“This means that 32% of the average American's annual cost of living adjustment for Social Security will be eaten up by an increase in health care costs,” wrote Horgan.

Others share that point of view.

"Everyone will feel the sting," said Marcia Mantell, founder of Mantell Retirement Consulting and author of "Creating Your Medicare Recipe: Your Guide to Enrolling on Time and Without Penalties."

"A 9.6% increase in just one year – especially in a year riddled with higher prices due to tariffs and stubborn inflation – is a tough pill to swallow (no pun intended!)," she said. "Seniors with more modest incomes are going to have a tough time absorbing this increase." Image source: Shutterstock/TheStreet

Social Security benefits: expected increase

According to the Social Security Administration, the average retired worker will see their monthly benefit rise from $2,015 to $2,071 starting in January of 2026, an increase of $56 per month.

Given the $17.90 increase in Part B premiums, which is deducted from a beneficiary’s Social Security check, the net increase in a Social Security beneficiary’s monthly check will be $38.10, and the before-tax check will be $2,053.10.

Of note, the Social Security law contains a hold-harmless provision that limits the dollar increase in the premium to the dollar increase in an individual’s Social Security benefit. It’s estimated that some four million Social Security beneficiaries will see their Part B increase capped because of the hold harmless provision.

Related: Retired workers to see frustrating change to Medicare in 2026

“This enrollment season it’s clear that the American consumer is feeling the squeeze of increased health care costs,” Horgan wrote. “All the talk about managing prescription drug costs has led to an increase in carrier changes – more carriers leaving markets, changing coverage, etc. The average American doesn't feel like health care is getting cheaper... it feels more expensive and more complicated.”

By way of background, the CMS noted Medicare Part B covers physicians’ services, outpatient hospital services, certain home health services, durable medical equipment, and certain other medical and health services not covered by Medicare Part A.

Each year, the Medicare Part B premium, deductible, and coinsurance rates are determined according to provisions of the Social Security Act, the CMS wrote in its release. The annual deductible for all Medicare Part B beneficiaries will be $283 in 2026, an increase of $26 from the annual deductible of $257 in 2025.

The increase in the 2026 Part B standard premium and deductible is mainly due to projected price changes and assumed utilization increases that are consistent with historical experience.

The CMS wrote: “If the Trump Administration had not taken action to address unprecedented spending on skin substitutes, the Part B premium increase would have been about $11 more a month. However, due to changes finalized in the 2026 Physician Fee Schedule Final Rule, spending on skin substitutes is expected to drop by 90% without affecting patient care.”

The CMS also noted that beginning in 2023, individuals whose full Medicare coverage ended 36 months after a kidney transplant, and who do not have certain other types of insurance coverage, can elect to continue Part B coverage of immunosuppressive drugs by paying a premium. For 2026, the standard immunosuppressive drug premium is $121.60.

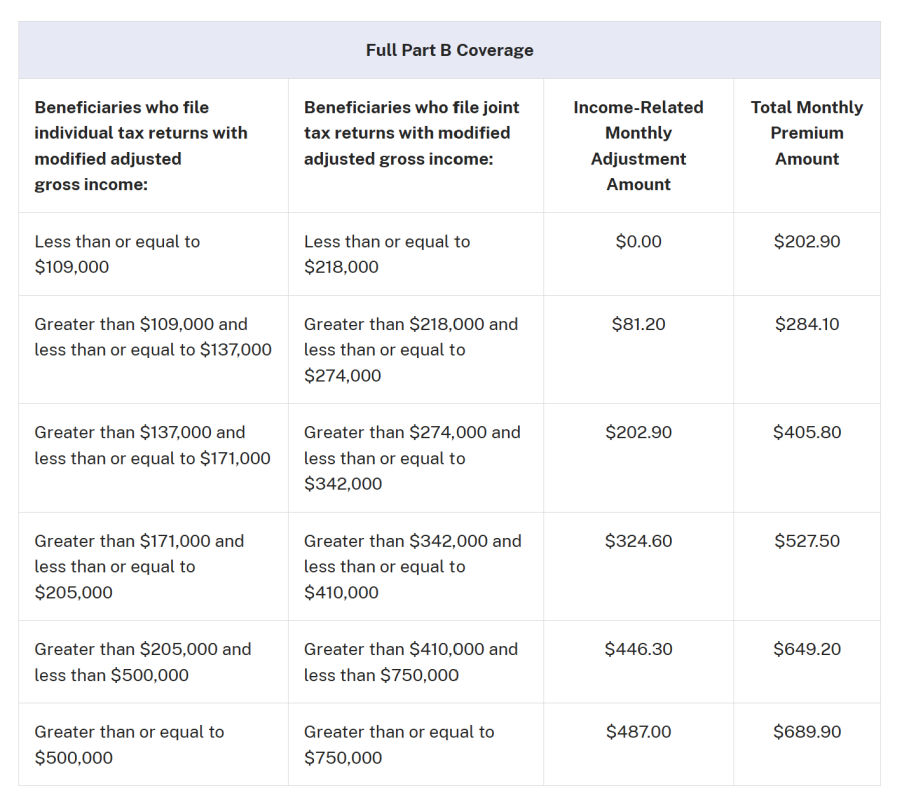

Medicare Part B income-related monthly adjustment amounts

Since 2007, a beneficiary’s Part B monthly premium has been based on his or her income. These income-related monthly adjustment amounts affect roughly 8% of people with Medicare Part B.

The 2026 Part B total premiums for high-income beneficiaries with full Part B coverage are shown in the following table:

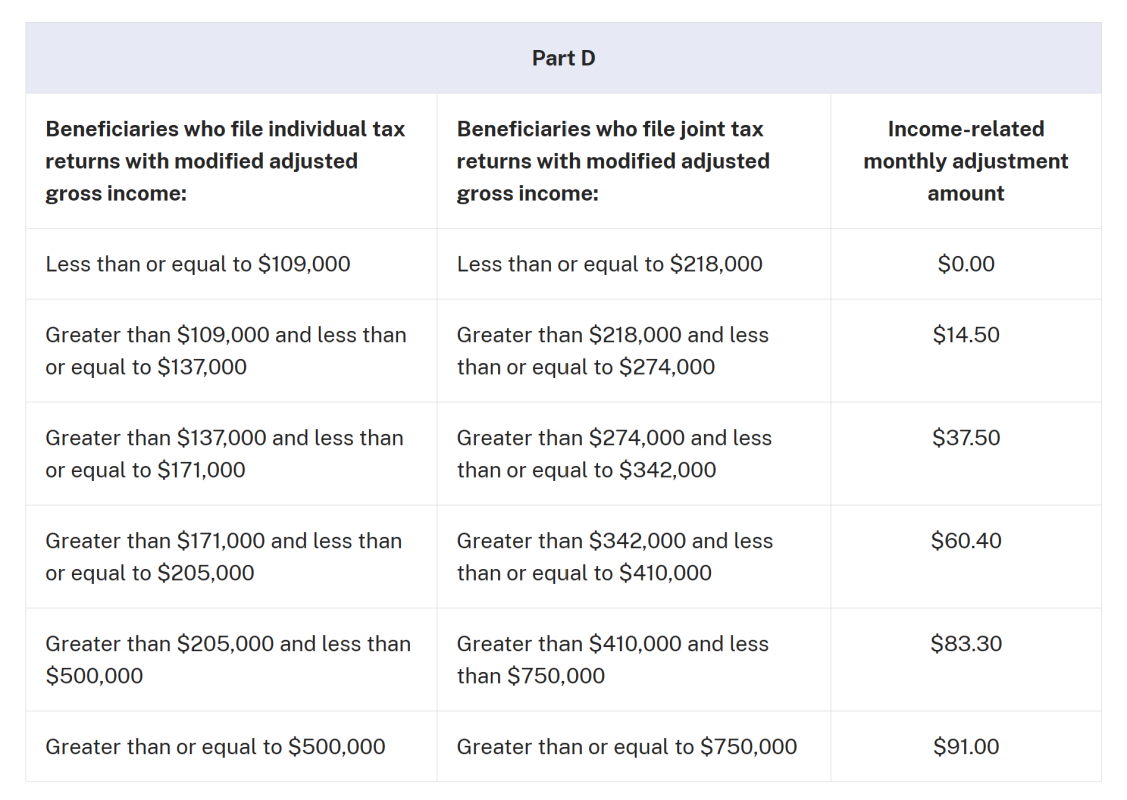

Medicare Part D income-related monthly adjustment amounts

Since 2011, a beneficiary’s Part D monthly premium has been based on his or her income. Approximately 8% of people with Medicare Part D pay these income-related monthly adjustment amounts, according to the CMS.

These individuals will pay the income-related monthly adjustment amount in addition to their Part D premium. Part D premiums vary by plan and, regardless of how a beneficiary pays their Part D premium, the Part D income-related monthly adjustment amounts are deducted from Social Security benefit checks or paid directly to Medicare.

Related: Millions of Medicare beneficiaries could see major price shock

Roughly two-thirds of beneficiaries pay premiums directly to the plan, while the remainder have their premiums deducted from their Social Security benefit checks. The 2026 Part D income-related monthly adjustment amounts for high-income beneficiaries are shown in the following table:

Mantell said the new IRMAA brackets will come as a surprise to many higher-income retirees.

“It’s a shock to see that two groups of high-income folks will now pay over $700 per person per month,” she said. Those with a Medicare MAGI of $750,000 and higher “will pay nearly $800 a month between Part B and Part D IRMAA –$780.90.” That figure is $66.20 more per month than last year. Still, she added, these households “have the income to comfortably offset this level of premium.”

Mantell noted that a newly affected group will also cross the $700 threshold. Retirees with Medicare MAGI between $410,000 and $750,000 for joint filers, or between $205,000 and $500,000 for single filers, will now owe $732.50 per person per month for Part B plus the B and D IRMAA surcharges.

“That’s going to be felt by those individuals who are just over the $205,000 threshold and for married couples at the low end of the bracket,” she said.

She added that many retirees fall into this IRMAA range. “It’s not hard for folks who have saved a lot in their IRAs and 401(k)s to have RMDs plus Social Security that push them into the $205,000 to about $300,000 territory,” Mantell said. “It’s a wide bracket and a lot of retirees fall into it.”

A retiree with a $3 million IRA, or even a 90-year-old with a $2 million IRA, could easily land in this bracket. “These are not the super-wealthy folks,” she said. “They just did a really good job saving for retirement.”

Medicare Part A premium and deductible

The CMS also noted the following:

Medicare Part A covers inpatient hospital, skilled nursing facility, hospice, inpatient rehabilitation, and some home health care services. Approximately 99% of Medicare beneficiaries do not have a Part A premium, since they have at least 40 quarters of Medicare-covered employment, as determined by the Social Security Administration.

The Medicare Part A inpatient hospital deductible that beneficiaries pay if admitted to the hospital will be $1,736 in 2026, an increase of $60 from $1,676 in 2025.

Part A inpatient hospital deductible covers beneficiaries’ share of costs for the first 60 days of Medicare-covered inpatient hospital care in a benefit period. In 2026, beneficiaries must pay a coinsurance amount of $434 per day for the 61st through 90th day of a hospitalization ($419 in 2025) in a benefit period and $868 per day for lifetime reserve days ($838 in 2025).

For beneficiaries in skilled nursing facilities, the daily coinsurance for days 21 through 100 of extended care services in a benefit period will be $217.00 in 2026 ($209.50 in 2025).

Related: Don't let your estate plan slip: beneficiary designations matter

What's Your Reaction?